Mark P. Dangelo: Strategy is NOT Dead—Across Housing Finance and Technology it is Too Traditional

Mark Dangelo currently serves as an innovation officer to private equity and VC funded firms spearheading digital fabrics, data sovereignty, MAD data science and decentralized finance. He is also a country leader for Dataswift.io and a graduate professor of innovation and entrepreneurship at John Carroll University. He is author of five books on innovation and a frequent writer for MBA NewsLink.

Strategy, vision, goals, even objectives are wonderful ideas representing operating principles—if they can be turned into measurable results which meet individual and corporate expectations. If they cannot be made concrete, efforts and fees are expended that fail to return results, while potentially wasting market advantages and emerging opportunities[i]. However, what value can strategy provide today—let alone tomorrow—delivered across systems and consumers who live digitally and adjust their behaviors at hyperscale?

For those who create or drive strategy innovation, there is a quote by Mark Twain that resonates, “It is not what we don’t know that gets us into trouble, it is what we know for sure that just isn’t so.” To understand those elements of strategy that “just isn’t so,” we begin with the cataloging the assumptions ignored and unattributed implications misunderstood across common, generalized industry strategies. Moreover, additional missing risks and implementation demands can be mapped to nearly 90% of the strategy failures measured over the last decade.

However, when measuring the success of the prescriptive industry strategies, are the results within the 20% leaders who achieve 80% of the initial goals or the 80% of organizations who comprehensively fail? Are the disappointments attributable to poor execution, incorrect technologies, external events, or perhaps just the wrong strategies?

And while we are shocked at the success or failures of strategies within our organization, the achievement of improved strategy designs requires a three-step approach—understanding why rationale has shifted, articulation of how digital business requires new strategy solutions, and devising an iterative plan-of-attack embracing strategy large program triple-constraints.

First: The Rationale Generating Strategy Failures

In the housing and mortgage markets we speak of digital transformations, data innovations, quantitative analytics, hybrid cloud computing, blockchain implementations, and of course, regulatory compliance. Our teams and consultants devise strategies aligned to market solutions and customer history to define streamlined transactional solutions contained within the over 80 distinct mortgage ecosystem processes and functional silos.

While strategists traditionally account for required training, the skills needed, the organizational on-boarding, the processes changes, or the implementable data standards, they are concentrated in rigid silos of the past industry structures of operating models constrained by managerial politics. As frontline personnel understand, strategies must be adaptable and transmutable to iteratively leverage internal and external market forces. Across expanding digital financial ecosystems, strategy success moving forward requires layers of components, complex and substitutable, to deliver across shortened timeframes and exploding digital demands.

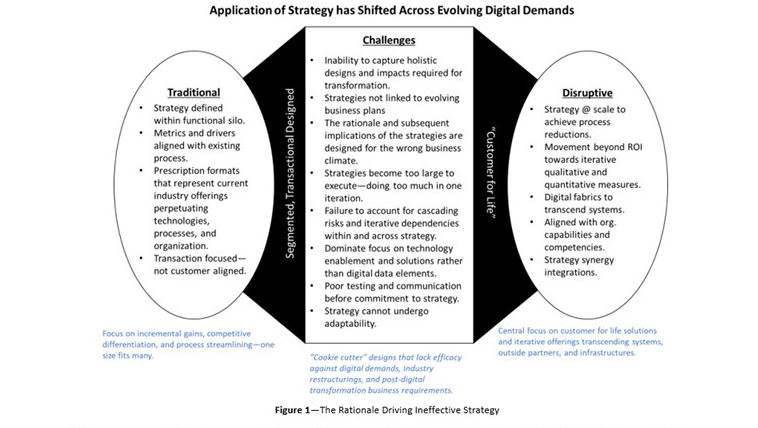

In Figure 1, the distinctions between traditional and digitally disruptive approaches highlight the challenges and the rationale for strategy failure within and across financial services disciplines. For mortgage operations, during periods of prolonged prosperity, incremental gains using traditional approaches are sufficient as volumes and margins make up for missed opportunities. Yet, when the markets pivot due to external factors or customer behaviors, the operating principles that did not interfere with profitability now are liabilities often ingrained within organizational cultures and practices.

[i] Since April of 2022, I have been progressively writing my columns towards a set of papers that will be released in October 2022 in advance of the MBA Annual Conference in Nashville, Tennessee. The end goal is to demonstrate beyond a doubt because the mortgage and financial industries are radically under pressure from more than structural economic changes.

The above graphic also demonstrates that the reusability of traditional “cookie cutter” strategy solutions fail to account for rapid-cycle innovational advancements, not only from vendors, but also from customers. Whereas the mindsets honed since 2010 to address volume demands served transactional system constructs (e.g., customer contact, origination, RON, Fintech), the assets for the evolving mortgage industry organizations now are centered on the customer and their control of their digital assets[i].

Examples of these stepwise shifts surrounding digital assets are contained in digital sovereignty regulations and the innovations that allow the consumer to manage and control their digital assets. The requirements for creating a digital customer for life are markedly different when compared against next-generational mindsets. Additionally, what criteria and drivers should be compared when creating action plan roadmaps for the next mortgage cycle? What shifts will IT and business leaders be measured against across transformative digital demands?

Second: What is Required Across Digital Housing and Finance Industries?

To holistically address the changes brought forth by the mortgage industry’s decade long digital transformation initiatives, we also must accept that there are cascading criteria and drivers that move industry demands deeper into digital only solutions. Strategy of tradition was driven by economic factors and operating assumptions that failed to encase digital trust across the multitude of Fintech software and cloud computing offerings. These lagging strategy results are now unmasking the flaws hidden by market volumes and exposed by external economic shocks (e.g., interest rates, inflationary pressures).

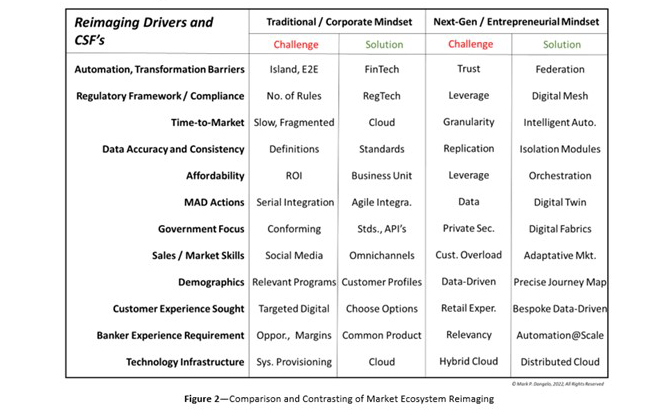

To accelerate the differences, it is likely that non-traditional competition will move their forthcoming solutions to data centric, hybrid cloud offerings linked by emerging digital fabrics, which deliver immutable and trusted systems of records regardless of vendor selected or customization undertaken. As the mortgage industry undergoes a comprehensive digital reimaging (see Figure 2), the challenges and solutions showcase vastly different strategy criteria and solutions between what is expected and what is needed to compete.

[i] Additionally, per the 2022 general trends cited by Financial Brands, the forecast for FDIC financial institutions continues to be negative. Since their peak of over 14,000 institutions in the 1980’s, the projections highlights that over 50% of the current 4,200 institutions will be lost in the next 20 years coupled with a shuttering of nearly 36,000 banking branches to just over 35,000—down from their Great Recession peak of nearly 90,000 branches. Yet, assets continue to expand but within larger institutions. Credit unions will adhere to a similar set of downward trends and consolidations. See “Grow or Die the Ultimatum for U.S. Banks.”

The above is a summary example of material challenges facing mortgage and financial leaders in 2022-2026. A new, comprehensive list of factors and operating models can be downloaded at the private equity ESG firm of 2nd Gen Partners (https://2ndgenpartners.com/), “Adapt or Die: The Mortgage Technology Ecosystem Reimaged for the Digital Consumer.”

After reviewing Figures 1 and 2, we can appreciate the step shift from traditional strategy towards next-generation digital demands. IT leaders will take less responsibility focusing on the app functionality and shift their expertise into data sciences and the digital data that spans traditional point-based solutions. Using digital fabrics and meshes and deploying actions that deliver orchestrated integrations, the ideas of what a CTO and CIO were will become CDO’s (Chief Data Officers) due to the critical profitability held within the exploding data assets.

And, while mortgage lenders are now starting to liquidate due to rising interest rates, the largest industry cull will be attributed to an inability to adapt to the digital demands imposed by customer shifts and regulatory oversight. Moreover, the inability to adapt innovative business models to meet the next-generational shifts will be the primary rationale for hundreds of failures in the next 18 months.

A quote among financial services CDO’s is, “Innovation starts with people using data—not technology.” Therefore, if we accept that digital assets for financial services presents the next normal, then what are the economic algorithms and strategy solutions that promote profitability? How should we aggressively pursue a plan of attack that delivers iterative implementation roadmaps aligned with shifting consumer usage, external factors, and innovational advancements?

Third: Delivering a Cohesive Plan of Attack (POA)

To deliver a next-gen POA, industry leaders must accept that unfamiliarity of data science concepts and the strategy solutions, which leverage their advancements should not exclude their consideration from digital mortgage ecosystems. Technological wish lists that incorporate innovations such as blockchain, cryptocurrencies, Web 3, embedded finance, hybrid clouds, or BaaS are only enablers if the underlying digital data empowers mortgage solutions across organizational and application boundaries.

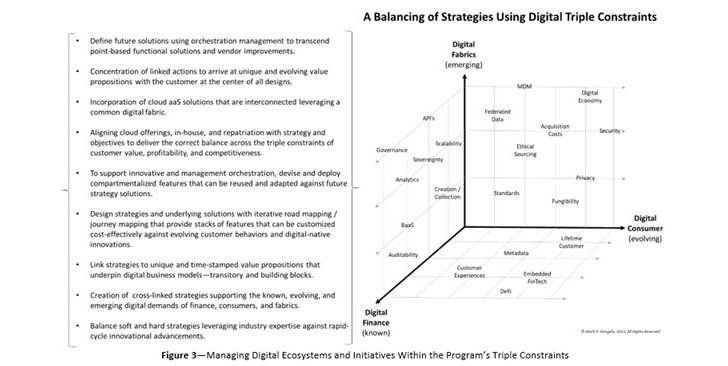

POA’s moving forward must address the complexities and tradeoffs of known, evolving, and emerging digital constraints (see Figure 3). Additionally, a balancing of strategies that recognize and leverage the transitory impacts of digital innovations moves from years of efficacy—to months and sometimes weeks. The consistency of the digital strategies resides with foundational and consistent digital fabrics and meshes linked together by 30-, 60-, 90-, and 180-day POA’s designed to create momentum and profitability against longer-term, iterative roadmaps.

For those IMB’s who for the last decade have gained market share as larger firms have exited the lending markets, the implications of these POA’s will have a significant impact on how your business model functions and profitability is achieved. POA’s also, in the context of the digital triple constraints, represent an inherent supply chain model that is linked by digital data[i]. To create POA’s against the strategies of customer focused digital offerings, it requires a fundamental shift of mindsets and allocation of resources to be able to compete against firms embracing “Amazonian” digital solutions.

[i] See “Adapt or Die: The Mortgage Technology Ecosystem Reimaged for the Digital Consumer,” by Mark Dangelo, downloadable from https://2ndgenpartners.com/.

Those organizations that are successful in embracing change to reach defined performance criteria all start with three end-state methods (and linked to the rationale and implications of the innovation trends and demands in Figure 3). First understanding the end state and working backwards to where they are today walking back through the sequence of actions and iterations needed. Secondly, understand the customer—their behaviors, their needs, and what they want—before designing the operational solutions. Now consider the decade of investments made by mortgage and financial leaders with item 2 above, the challenges moving forward reside with item 1. The third step is the integration of the first two to create a consistent stream of actions where data is monetized and made fungible—the more the data is used, the greater value it delivers all for a near zero cost of reuse (e.g., representing a digital fabric).

The POA is the culmination of understanding and acting upon organizational capabilities against rising market demands. Strategy dished out using traditional or incrementally adjusted prescriptive formats will fail to work moving forward. Strategies demand layers of progressive builds and will run counterintuitive to the premise of traditional definition and execution. With a comprehensive reimaging of the mortgage ecosystems underway, are you confident that the tradition mindsets will resonate with customers and competitors moving away from technology driven strategies—in favor of digital ones?

In Summary: An Inability to Think Strategically

What is often surprising is the success rate of digital solutions—less than 25% are meet their objectives for the most successful, and an extremely low single digit for those firms experiencing cultural resistance and skill voids common within legacy industries (e.g., healthcare, FSI). Strategy has been a great segmentation discipline, but it often fails to achieve results. Strategy implementation challenges are now made worse in a comprehensive digital economy and the innovative relevance of their traditional actions will continue to struggle.

To compete in the digital ecosystems, strategies must be layered and multifaceted when compared to the point-based traditional ideas. Indeed, digital strategies and lexicons for most of the financial and mortgage industries are unfamiliar, yet they represent the next evolutionary step for digital transformation efforts undertaken during the last decade. By accepting that “complex” and “unfamiliar” strategy solutions are non-starters (for a legacy industry such as mortgage banking), the result is that traditional strategy advancements will only offer incremental benefit against lagging financial measures rather than stepwise improvements against forward looking customer criteria.

As illustrated in Figure 3, the solutions and market drivers are not traditional as many are defined and driven by rapid advances within innovational, data science disciplines. For independent mortgage bankers (#IMB) struggling with rising rates (i.e., See @Bloomberg, “US Mortgage Lenders Are Starting to Go Broke”), these advancements may prove to be a demand too far given existing business models. Alternatives for these firms to rapidly transform their operations will reside with innovative business process outsourcers, vendor offerings designed around digital fabrics, cooperative’s where smaller firms can leverage their resources, and of course, M&A events where well capitalized organizations can achieve digital automation @ scale.

For leaders seeking solace from market disruptions, the adherence to traditional strategy ideals and practices will lead to greater despair. Without the rapid movement to “digital mortgage ink” (#DMink) processes underpinned by a supply chain mindset, the signs for “going out of business” will get worse before it gets better. In the end, is it a failure of strategy—or an inability to think strategically? In the end, it will be for many noted leaders and their organizations, a challenge—do we adapt, or do we die underneath the transition pressures from technology strategy to a digital one[i]?

[i] ibid

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)