CoreLogic: ‘Balance’ Returning as Home Prices Growth Dips Amid Higher Mortgage Rates

CoreLogic, Irvine, Calif., said annual home price appreciation fell for the third straight month in July as higher mortgage rates cooled off a red-hot housing market.

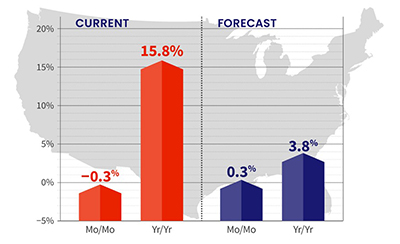

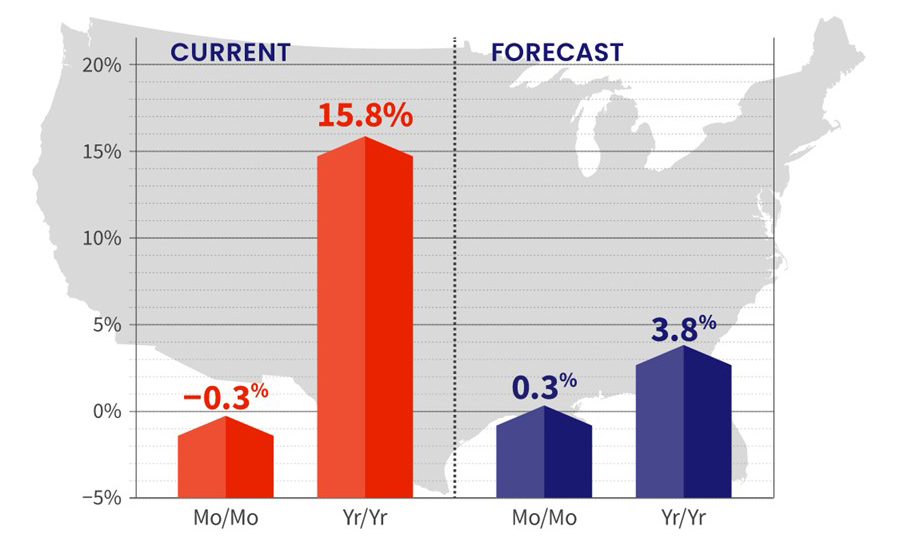

The monthly CoreLogic Home Price Index posted a still-elevated 15.8 percent annual gain in July, but was well down from its 20-percent-plus pace earlier this year. On a monthly basis, the HPI fell by 0.3 percent from June to July, compared to 0.5 percent growth from May to June.

CoreLogic noted as 30-year, fixed-rate mortgages neared 6% this summer, some prospective homebuyers pulled back, helping ease overheated and unsustainable price growth. Looking ahead, CoreLogic interim lead economist Selma Hepp expects to see a “more balanced” housing market, with year-over-year appreciation slowing to 3.8% by July 2023.

“Following June’s surge in mortgage rates and the resulting dampening effect on housing demand, price growth is taking a decisive turn,” Hepp said. “And even though annual price growth remains in double digits, the month-over-month decline suggests further deceleration on the horizon. The higher cost of homeownership has clearly eroded affordability, as inflation-adjusted monthly mortgage expenses are now even higher than they were at their former peak in 2006.”

The report said annual appreciation of detached properties (16.1%) in July was 1.5 percentage points higher than that of attached properties (14.6%).

Tampa, Fla., logged the highest year-over-year home price increase of the country’s 20 largest metro areas in July, at 29.7%, while Miami moved into the second slot at 27.1%. Florida and South Dakota posted the highest home price gains, 29.6% and 23.7% respectively. Tennessee ranked third with a 23.2% year-over-year increase. Washington, D.C. ranked last for appreciation at 2.4%.