MBA Advocacy Update Sept. 12 2022

On Tuesday, MBA submitted a letter to FHA leadership detailing member recommendations on improving the FHA 203(k) Mortgage Rehabilitation Insurance Program. And on Friday, MBA released a new white paper, A Framework for Considering Office Demand in a Post-Pandemic World, which details relative benefits and costs of remote and in-person work to employees and employers and analyzes the outlook for the office sector and potential impacts to commercial mortgage loan volume and property values.

Home Building Increases in Disaster-Prone Areas

More than half of homes built today face fire risk, compared to 14% of homes built from 1900 to 1959, as suburbanization and a shift to the Sun Belt push builders into more vulnerable areas, said Redfin, Seattle.

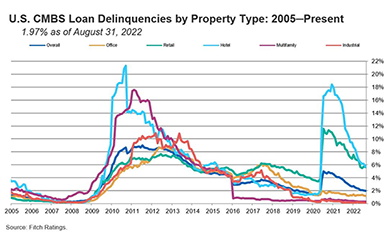

CMBS Loan Delinquency Rate Drops Below 2%

Fitch Ratings, New York, said the commercial mortgage-backed securities delinquency rate fell eight basis points in August to 1.97% due to continued strong resolutions and fewer new delinquencies.

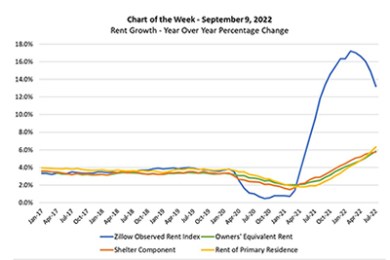

MBA Chart of the Week: Rent Growth–Year-over-Year Percentage Change

This week’s MBA Chart of the Week highlights a question related to housing costs and inflation: If home price appreciation and rent growth have been in double digits in the past few quarters—as highlighted by the (blue lined) Zillow Observed Rent Index in the chart—why is the shelter component (orange line) of the Consumer Price Index below 6%?

The Week Ahead, Sept. 12, 2022: What You Need to Know

NASHVILLE, TENN.—Good morning and happy Monday! MBA NewsLink comes to you here from the MBA Risk Management, QA and Fraud Prevention Forum.