MBA Advocacy Update June 6 2022

MBA sent a letter to the FDIC Friday on its climate risk management principles for financial institutions. On Tuesday, MBA and the Housing Policy Council responded to HUD’s proposed 40-year modification, which would increase the maximum allowable term for an FHA-insured loan modification from 360 months to 480 months. And recently, FHFA finalized two rules related to the Enterprise Regulatory Capital Framework for Mac the GSEs.

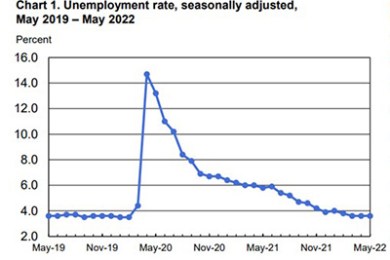

Employers Add 390,000 May Jobs; Unemployment Rate Holds at 3.6%

Employers added nearly 400,000 jobs in May, largely meeting expectations, the Labor Department reported Friday. The unemployment rate held at 3.6 percent for the third straight month.

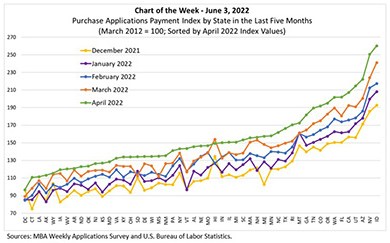

MBA Chart of Week June 3, 2022: MBA Purchase Applications Payment Index

In March, MBA released its inaugural monthly Purchase Applications Payment Index (PAPI) – an affordability index that measures how new fixed-rate 30-year purchase mortgage payments vary across time relative to income. The third PAPI release on May 26 – based on April MBA Weekly Applications Survey data – gives us a picture of how affordability has been affected by increasing interest rates and elevated loan application amounts in the first third of 2022.

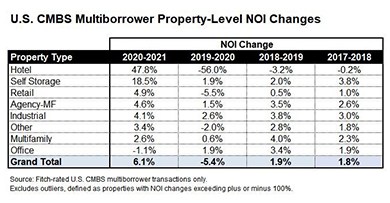

Fitch: CMBS Properties See NOI Recovery

Fitch Ratings, New York, reported property-level net operating income for commercial mortgage-backed securities loans rebounded 6.1 percent on average in 2021.

MISMO Issues Reporting Guide on Forbearance Data Exchange

MISMO®, the real estate finance industry standards organization, launched a new guide and sample credit response to help industry professionals using MISMO Reference Models v3.4 and v3.5 better report on loans that have been in or are in forbearance.