Employers Add 390,000 May Jobs; Unemployment Rate Holds at 3.6%

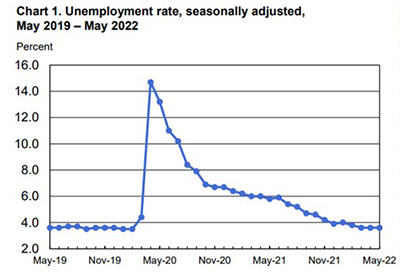

Employers added nearly 400,000 jobs in May, largely meeting expectations, the Labor Department reported Friday. The unemployment rate held at 3.6 percent for the third straight month.

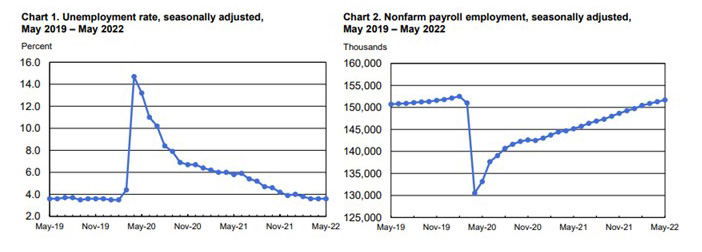

The report said total nonfarm payroll employment rose by 390,000 in May. Notable job gains occurred in leisure and hospitality, in professional and business services and in transportation and warehousing. Employment in retail trade declined.

The Bureau of Labor Statistics said nonfarm payroll employment for March revised down by 30,000, from +428,000 to +398,000, while April revised up by 8,000, from +428,000 to +436,000. With these revisions, employment in March and April combined was 22,000 lower than previously reported.

The report said the number of unemployed persons was unchanged at 6.0 million. Both the labor force participation rate, at 62.3 percent, and the employment-population ratio, at 60.1 percent, were little changed over the month. Both measures are 1.1 percentage points below their February 2020 values.

“There are still millions more job openings than people available to fill them, and wage growth remains strong, with average hourly earnings up 5.2% compared to last year,” said Mike Fratantoni, Chief Economist with the Mortgage Banker Association. “By almost any measure, this is one of the strongest job markets in the past 50 years.”

Fratantoni noted construction employment increased by 36,000, with 16,000 of that growth in the residential sector. “Although housing inventory is beginning to increase, demand continues to exceed supply even as mortgage rates have spiked,” he said. “The continued strength in the job market will provide ongoing support to housing demand.”

Fratantoni also observed the report will likely support additional 50-basis-point hikes by the Federal Reserve at the next two Federal Open Market Committee meetings. “Even if inflation readings show some deceleration, this degree of labor market tightness will likely continue to put upward pressure on wages and prices,” he said.

Sarah House, Senior Economist with Wells Fargo Economics, Charlotte, N.C., agreed. “Today’s report lands in a sweet spot for the Fed,” she said. “While the labor market remains clearly tight and is adding to inflationary pressures, improving labor supply is helping ease the upward pressure on wages while still allowing more workers to gain employment. But there is a long way to go before restoring the balance to the jobs market that will be needed for the Fed to win the battle on inflation, keeping the FOMC on track to tighten monetary policy aggressively at its next few meetings.”

House noted nonfarm employment is down by 822,000, or 0.5%, from its pre-pandemic level. Three major sectors account for these missing jobs: leisure & hospitality (down 1.3M from February 2020), health care (down 223K) and state and local government (down 634K). “Encouragingly, all three of these sectors saw solid job growth in May, including a 52K employment increase for state and local governments, the largest increase since June 2021,” she said.

“With May’s increase, the U.S. economy has now regained 96% of the jobs lost in the pandemic,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “If gains continue at the May pace, we could return to the pre-COVID employment peak by August.”

Kushi said May proved a solid report for construction jobs. “In May, job gains were highest for specialty trade contractors, which added 17,000 jobs, and heavy and civil engineering construction, which added 11,000 jobs,” she said. “Construction employment is 40,000 higher than it was in February 2020…Construction quits rate remained high in April, which is not good news for the labor-intensive construction industry. Builders still have a backlog of uncompleted homes to get through, and it’s hard to complete a home without skilled construction workers.”

“This report should cement the Federal Reserve’s commitment to aggressive policy tightening over the coming months,” said Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C.

The report said average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents, or 0.3 percent, to $31.95 in May. Over the past 12 months, average hourly earnings have increased by 5.2 percent. In May, average hourly earnings of private-sector production and nonsupervisory employees rose by 15 cents, or 0.6 percent, to $27.33.

BLS also noted the average workweek for all employees on private nonfarm payrolls in May was 34.6 hours for the third month in a row. In manufacturing, the average workweek for all employees was little changed at 40.4 hours, and overtime fell by 0.1 hour to 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls remained unchanged at 34.1 hours.