BREAKING NEWS

Loans in Forbearance Fall to 1.30%; Mortgage Applications Fall to 2-Year Low

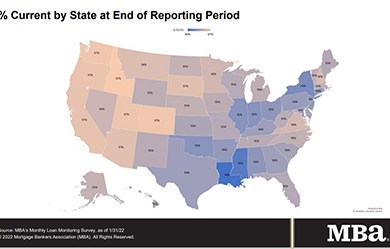

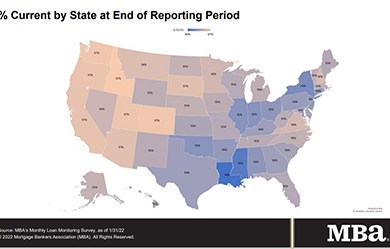

Loans in forbearance fell again in January to pre-pandemic lows, the Mortgage Bankers Association reported on Monday.

Mortgage applications fell to their lowest level since December 2019 as mortgage interest rates stayed above 4 percent, the Mortgage Bankers Association reported Wednesday in its Weekly Applications Survey for the week ending Feb. 18.

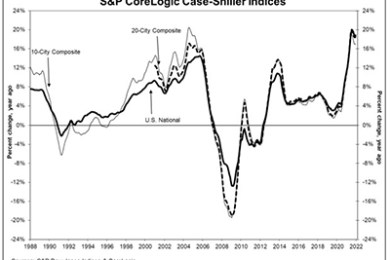

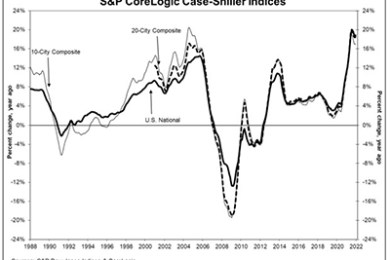

The S&P CoreLogic Case-Shiller Home Price Indexes finished 2021 with the single-highest rate of increase in 34 years of data-keeping. In a separate report, the Federal Housing Finance Agency said 2021 home prices rose by 17.5 percent.

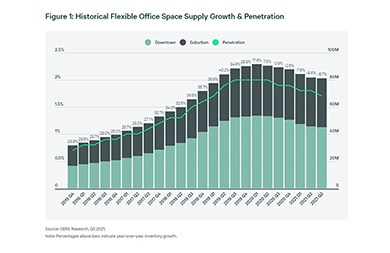

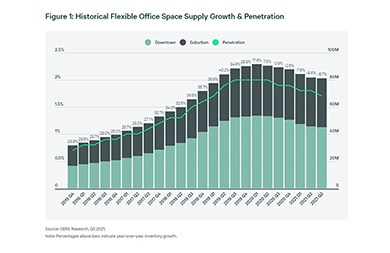

CBRE, Dallas, said the flex-office sector has grown more sophisticated during the pandemic and is helping employers accommodate changing office-use patterns.

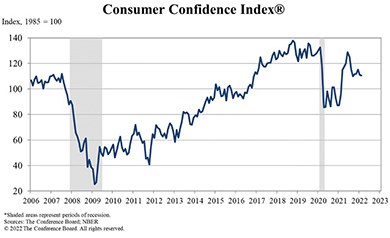

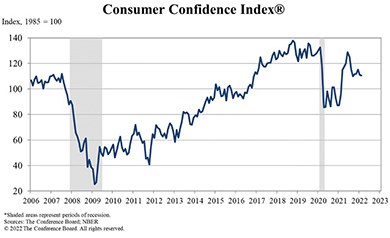

The Conference Board, New York, said its Consumer Confidence Index fell for the second straight month in February to its lowest level since October, as expectations continued to weaken.

RE/MAX, Denver, said January home sales followed a more predictive pattern as of late, dropping more than 30% from December.

Merchants Capital, Carmel, Ill., secured $110 million in financing for Parkside 8 and Parkside 10, two mixed-use workforce housing developments in Washington, D.C.

Last Monday, MBA submitted comments to the OCC on draft principles for large banks’ management of climate-related financial risk. On Tuesday, the FHA announced it is extending the mandatory implementation deadline for mortgagees to begin delivering appraisals through the FHA Catalyst: Electronic Appraisal Delivery Module.

mPower presents the next in its Career Webinar series, Being You is Your Superpower! on Monday, Feb. 28 from 2:00-3:00 p.m. ET.

Our recent acquisition was the exception: Pacific Western Bank provided us with the capital base to take us to new levels without “bankifying” us, and our business has had 12 straight record-breaking months since. It’s been a tremendous success. Given the likelihood there will be many more acquisitions in the industry’s near future, it seems useful to look back and understand why.

Author Robert H. Schuller is credited for the saying, “Tough times never last, but tough people do.” As the historic refinancing boom has ended and flips to a purchase market, lenders need to be thinking it is time to get tough.

Incenter LLC, Philadelphia, named Shelley Duffy Senior Vice President of Enterprise Sales.

The Mortgage Bankers Association’s annual Technology Solutions Conference & Expo takes place Apr. 11-14 at the Bellagio Las Vegas.