CBRE: Flex-Office Sector Positioned to Adapt

CBRE, Dallas, said the flex-office sector has grown more sophisticated during the pandemic and is helping employers accommodate changing office-use patterns.

“Flex space has become a ‘skeleton key’ that companies can use to address their changing office needs,” said Julie Whelan, CBRE Global Head of Occupier Research. “They can use it to adjust their office portfolio as they figure out how hybrid work will affect their employees’ office-use patterns. They can use flex space as a short-term base when they initially expand into new markets to tap new and more affordable labor pools.”

Whelan noted some companies add flex space in suburban locations to offer employees offices for occasional use closer to their homes than a downtown location. “In short, flex space allows companies to be more nimble,” she said.

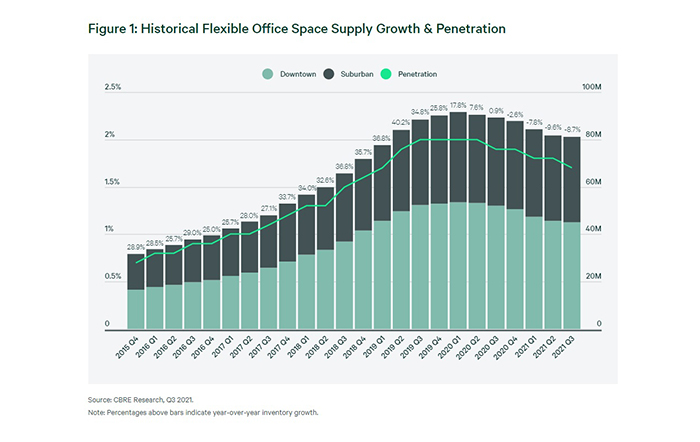

The flex sector, which expanded significantly in 2018 and 2019, has slimmed down since early 2020, CBRE said in a report, Awakening an Era of Flexibility. The firm found North American flex-space providers collectively trimmed their square footage by 9 percent to slightly more than 80 million square feet in the 12 months ending in September. Similarly, the sector’s penetration as a percentage of overall office space declined from nearly 2 percent to 1.75 percent.

Having thus “reset” itself, the flex sector is now poised for growth this year as big companies increasingly embrace the format’s versatility to handle changing staffing levels and fluctuating office attendance, CBRE said. Its survey of 185 U.S.-based companies found large companies anticipate adding more flex space to their office portfolios. Last year, nearly a quarter of the survey’s respondents had a significant portion (more than 10 percent) of their office portfolio in flex space. By 2023, half expect to be at or past that threshold.

“To that end, major flex-office providers recently reported gains in their business with big companies or enterprise users,” the report said.

CBRE analyzed flex office in 49 North American markets. It found 15 recorded a net expansion of their flex square footage in the year ending in September, 28 notched a net contraction and six saw no change. The biggest expanders were secondary and satellite markets such as the San Francisco Peninsula (a 13.9 percent gain) and suburban Maryland (5.9 percent gain). Houston (5.2 percent gain) was the largest market to post an increase.