Housing Report Roundup, Mar. 1, 2022

Here are summaries of recent housing market reports that came across the MBA NewsLink desk.

CoreLogic: 2021 National Average Property Tax Delinquency Rate Declines

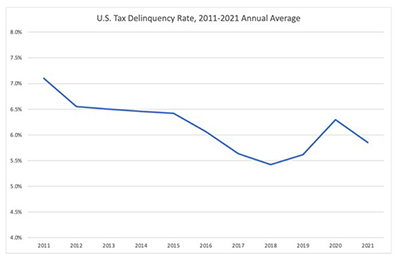

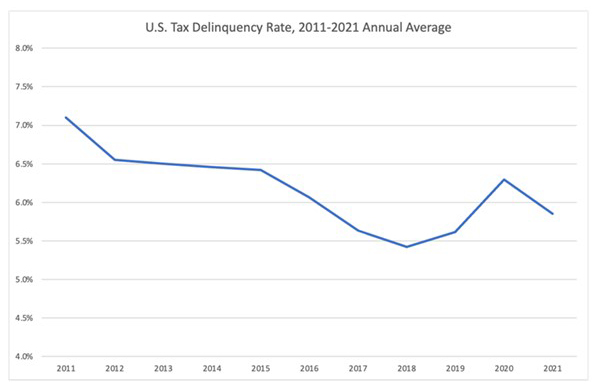

CoreLogic, Irvine, Calif., released its Real Estate Property Tax Delinquency Report, which analyzes real estate property tax delinquency changes nationally and at state levels and shows a national average delinquency rate of 5.9% for 2021, down 0.4% from the year prior.

“Homeowners in financial distress are more likely to be late on their property tax payment,” said Frank Nothaft, CoreLogic chief economist. “During the past decade, 2011 had the highest annual average unemployment and tax delinquency rates. Unemployment was at its lowest in 2018 and 2019, the two years with the lowest delinquency rates. The rise in delinquency in 2020 and decline during 2021 reflects the large job loss during the early months of the pandemic and substantial job gain of last year.”

The report said states with the highest average property tax delinquency rates in 2021 were Mississippi (15.6%), Delaware (14.5%), Virginia (10.5%), New Jersey/Massachusetts (tie) (10.2%) and Washington, D.C. (10.1%). States with the lowest average property tax delinquency rates in 2021 were North Dakota (1.2%), Minnesota (1.3%), Wisconsin (1.5), Illinois (1.8%) and Utah (2.2%).

In 2021, North Dakota had the lowest percentage of property tax delinquencies at 1.2%. For the same year, Mississippi had the highest with a rate of 15.6%. The 14.4% gap in between the lowest and highest rates in 2021 is slightly less at 13.9% for period spanning 2011 through 2021. Over that time, Minnesota had the lowest average property tax delinquency percentage of 2.0% while Mississippi had the highest rate of 15.9%.

STRATMOR Group: Lenders Have Window of Opportunity as Market Enters a Classic Down Cycle

STRATMOR Group, Greenwood Village, Colo., said mortgage executives are seeing the signs of a coming downturn and are considering the changes they’ll need to make to remain competitive, according to this month’s Insights Report from mortgage advisory firm STRATMOR Group.

In his article in the company’s monthly Insights Report, “As the Mortgage Market Turns: Lender Perspectives on the 2022 Market,” Senior Partner Jim Cameron details the challenges discussed in recent STRATMOR Group Operations and Technology Workshops.

“While 2021 turned out to be a very good year by historical standards, the trend lines are troubling,” Cameron said. “We are in the beginning stages of a classic down cycle: Volumes are down, revenue is declining and cost per loan is going up as lenders are spreading their fixed cost base over a shrinking number of loan units. To pile on, it costs more to originate a purchase loan than a refinance due to a variety of factors.”

Cameron analyzed data on numerous industry indicators including cycle times, staffing levels and appraisal turn times. He said the industry’s long-running conundrum: the “too busy vs. too poor” syndrome, and stresses that lenders now have more time than they did during the hectic period from 2020-2021. Lenders also have a much stronger capital position than they did in 2018-2019. “Lenders therefore have an opportunity to act now before the red ink starts flowing and a ‘siege mentality’ starts to creep in.”

“It’s tough sledding out there,” Cameron said. “The good news is that many lenders are seeing these signs as well and are reporting back to us that they realize changes will be required to succeed as we move through this part of the cycle.”

The article and other stories appear at https://www.stratmorgroup.com/insights-report/.

First American: Rising Rates Could Bring Balance to Housing Market

First American Financial Corp., Santa Ana, Calif., released the December Real House Price Index, reporting real house prices increased 1.9 percent between November and December and by nearly 22 percent year over year.

The report said consumer house-buying power increased by 0.04 percent between November and December and decreased by 0.2 percent year over year. Median household income has increased 5.2 percent since December 2020 and by 69.3 percent since January 2000.

The report also noted while real house prices are 4.8 percent less expensive than in January 2000 and unadjusted house prices are now 44.5 percent above the housing boom peak in 2006, real, house-buying power-adjusted house prices remain 33.2 percent below their 2006 housing boom peak.

“Even though household income increased 5 percent since December 2020 and boosted consumer house-buying power, it was not enough to offset the impact of higher mortgage rates and rising nominal prices on affordability,” said First American Chief Economist Mark Fleming. “In the near term, affordability is likely to wane further, as mortgage rates are expected to continue to rise and the pace of house price appreciation exceeds gains in household income. How buyers and sellers react to higher rates may help the housing market regain some balance.”

The report said states with the greatest year-over-year increase in the RHPI were Arizona (+34.3 percent), Florida (+32.0), South Carolina (+29.4 percent), Connecticut (+28.6 percent) and Georgia (+28.4); no states posted a year-over-year decrease.

Among top metros tracked by First American, markets with the greatest year-over-year increase in the RHPI were Phoenix (+36.3 percent), Charlotte, N.C. (+36.0), Tampa, Fla. (+32.9 percent), Raleigh, N.C. (+31.5 percent), and Atlanta (+31.5 percent). No markets posted a year-over-year decrease.