BREAKING NEWS

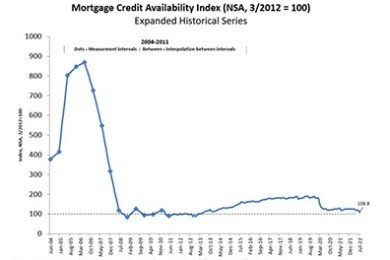

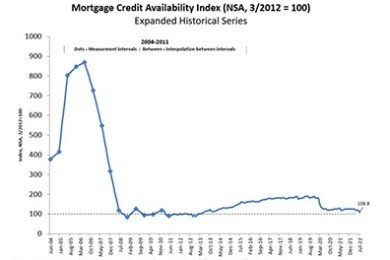

Mortgage Credit Availability Falls to 9-Year Low

Mortgage credit availability fell for the fifth straight month in July to its lowest level in nine years, the Mortgage Bankers Association reported Tuesday.

The Mortgage Bankers Association last week sent a letter to federal regulatory agencies, discussing several topline issues it says are crucial to improving the current Community Reinvestment Act framework.

MISMO®, the real estate finance industry standards organization, announced availability of its Commercial Green Borrower Questionnaire.

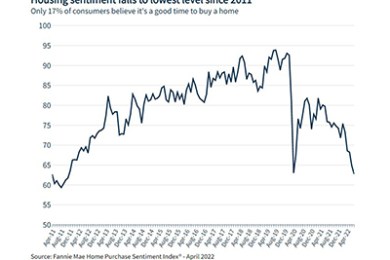

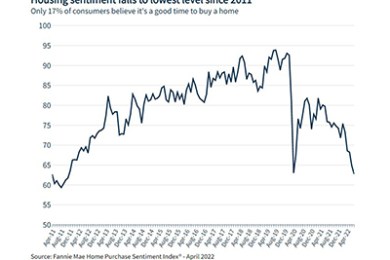

Fannie Mae, Washington, D.C., said its Home Purchase Sentiment Index fell by two points in July to 62.8, its lowest level since 2011 and well below the record high set in 2019.

Black Knight, Jacksonville, Fla., said mortgage production pulled back at the end of July, falling by 49 basis points from June to 5.30%.

U.S. commercial real estate property prices grew at a double-digit rate in June amid sustained demand, reported Real Capital Analytics, New York.

The Senate on Sunday passed a $740 billion reconciliation package. And last Monday, the VA released Circular 26-22-13, implementing new appraisal procedures for VA purchase loans.

Merchants Capital provided more than $13 million in financing to a joint venture between Gorman & Co. and the Gary, Ind. Housing Authority to rehabilitate Carolyn Mosby Apartments.

When the mortgage industry is in a constant state of change, it's important for lenders to stay on top of their game. With new reports coming out every day about market dynamics, competitive pressures, supply shortages and the persisting economic impacts of the global pandemic – mortgage lenders may be seeking ways to remain profitable and compliant.

According to a 2019 McKinsey study, lack of production data is the number one cause of poor hiring decisions across the mortgage industry.

Reimaging of the mortgage markets has begun—driven by shrinking margins, rising rates, and inflationary pressures. Yet, for all the actions since 2010 involving data standards, digital transformations, and customer experiences, what is missing? Who will be left standing as the next cycle takes form and the mortgage industry is digitally reimaged?

Lenders that hunkered down during the last two major industry downturns are no longer in the business, while those that leaned in and innovated during the same period emerged as industry leaders. Now is not the time for timidity. In fact, leading lenders are leaning into innovation now. There are at least three good reasons to do so.

Two years after the height of the COVID lockdown, there’s lots of new data available to prove (or disprove) some of the early predictions and observations regarding home buying patterns and trends.

The MISMO Fall Summit takes place Aug. 29-Sept. 1 at the Fairmont Georgetown Hotel in Washington, D.C.