MBA Chart of the Week Aug. 8, 2022: Mortgage Payment to Rent Ratio

The national median mortgage payment was $1,893 in June, according to the latest MBA Purchase Applications Payment Index (PAPI) release. While it held steady over the second quarter (from $1,889 and $1,897 in April and May), it was up 9.1% from the end of the first quarter, and $510 (36.9%) in the first half of 2022.

Similarly, the mortgage payment for the 25th percentile loan application (where one-quarter of purchase applications are for a lower amount and three-quarters for a higher one) was flat in the second quarter but increased by 38.5% from December 2021 to $1,241 in June.

Soaring housing costs are not restricted to owner-occupied homes. Indeed, according to the U.S. Census Bureau’s Housing Vacancies and Homeownership survey, the national median asking rent increased by 20.1% from the fourth quarter of 2019 to the fourth quarter of 2021, and the quarter-on-quarter increase was 4.0% in the first quarter of 2022. New CPS/HVS data, released this week, shows that the quarterly increase in the national median asking rent intensified to 4.7% in this year’s second quarter, increasing from $1,255 to $1,314.

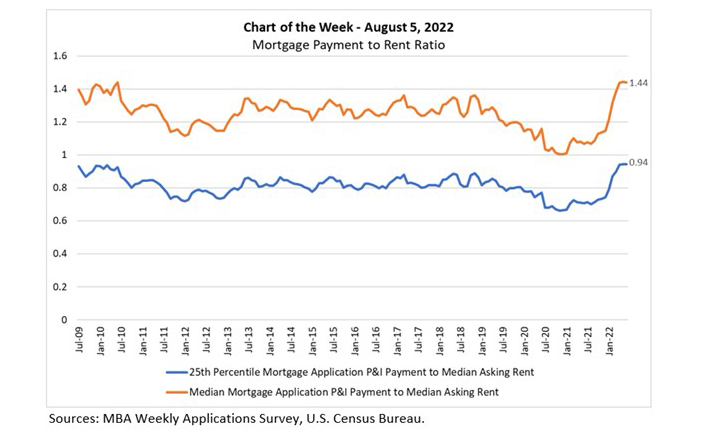

This MBA Chart of the Week examines the relationship between mortgage payments and asking rents since the second half of 2009. MBA’s national mortgage payment to rent ratio compares the national median and 25th percentile mortgage payments to the national median asking rent.

The MPRR that compares the median mortgage application P&I to the median asking rent (orange line) bounced between approximately 1.20 and 1.40 from 2013 through 2019. It then decreased to 1.00 in 2020 (a series low), before increasing to 1.15 at the end of 2021, and jumping to 1.38 in March 2022 (highest since 2010). The increase in the first quarter continued at a decelerated pace in the second quarter of this year, with the MPRR reading 1.44 in both May and June.

Similarly, the 25th percentile purchase mortgage application payment to median asking rent ratio—the MPRR measure that may be more apt for first-time homebuyers—remained around 0.80 from 2013 to 2019. It was down to 0.66 at the end of 2020 and back up to 0.74 at the end of 2021. After jumping to 0.90 in March, it reached a series high of 0.94 in June.

MBA’s mortgage finance forecast calls for house price appreciation to fall to 2.7% in the fourth quarter, and for the 30-year fixed rate mortgage rate to be at 5.2%. This is welcome news for potential home purchasers. Whether the MPRR falls back to lower levels also depends on rent increases. Recent data suggests that while rents are still rising at a historically fast pace, there are signs of softening. We will continue to monitor and report these developments.

–Edward Seiler eseiler@mba.org