Mark P. Dangelo: In Perspective, the Fragmentation of the Mortgage Industry

Mark P. Dangelo is Chief Innovation Officer with Innovation Expertus, Cleveland, Ohio, responsible for leading and managing global experiential teams for business transformations, digital projects and innovation-based advisory services. He is also president of MPD Organizations LLC and an adjunct professor of graduate studies in innovation and entrepreneurship at John Carroll University. He is the author of five innovation books and numerous articles and a regular contributor to MBA NewsLink. He can be reached at mark@mpdangelo.com or at 440/725-9402.

Financial and mortgage markets, when it comes to risks and crisis, are like other industries—frequently seeking out a prescriptive model, unique software or organizational design that mitigates challenges while offering roadmaps for the future. The focus is on “action,” or doing something that demonstrates to customers and investors leadership has the plan to ensure profitability and survival. But, facing a galaxy of data, changing customers and unscripted global conditions, will the traditional mindset of movement or copying the competition be enough to chart future viability?

First: What Does the Future Hold Against Today’s Challenges?

Let’s ask the $3.5 trillion-dollar question that has definitively surfaced—“Do market conditions and implications represent the ‘next’ normal for the financial services and mortgage industries, or is this a temporary aberration before a resurgence?” As industry layoffs rise and technology funding falls, the consensus is that for the remainder of 2022 the financial and mortgage markets will be significantly smaller, more competitive and dominated by digitally native firms. Will these conditions last beyond 2022 or 2023, and will other economic and opaque realities pressure consumers, investors and regulators?

With housing, building and realtor data as evidence, mortgage lenders need to find solutions that dramatically increase per loan margins for those buyers who remain as total residential volume estimated in the second half will likely be at an annualized $2.0 to $2.2 trillion market size—down from more than $3.2 trillion at the beginning of the year.

In 2022, stock markets have wiped nearly $4 trillion from individual savings in the U.S. just as inflation tops a 40-year highwater mark at over 9%. The traditional mortgage industry survives on volume to mitigate shrinking margins on a commodity product, and when volume falls so does the number of mortgage bankers. And as traditional players and their software vendors advocate for “simplicity” where one-size-fits-all, non-traditional firms are weaving together complex, correlated data using atypical algorithms, machine learning and artificial intelligence.

Stepping back 10 months to the conclusion of MBA Annual 2021, the published consensus from industry leaders was that mortgage rates would be perhaps 30-45% higher by October 2022—rates then were averaging 2.5% to 3% at that time. Today, mortgage rates average between 5.5% and 7% with the Federal Reserve (#FED) contemplating additional rate hikes easily pushing up rates another 1% to 1.5% before the end of 2022. The 200% to 300% rate increases are having far-ranging impacts across selling strategies, builder’s demand projections, consumer savings, and apartment rents as homeownership rapidly comes under pressures not experienced since the 1980’s. Yet are these the only impacts?

Since 2010, investments in technology have doubled under demand pressures from regulators, and more importantly, the rise of digital only consumerism that represents today’s financial customer. To underscore the urgency economic shifts and the breadth of technology implications, full-service financial firms in 2022 are increasingly joining forces with leading #Neobanks, which are adding 400K to 1,000K customers every month while decreasing the cost to acquire a customer by nearly 75%.

Rather than remake their existing infrastructure and cloud offerings, well positioned financial and mortgage firms are partnering with others or acquiring their capabilities as part of forward-leaning acquisition strategies. The time-to-market is demanding faster action than traditional provisioning.

With the rise of non-traditional firms driven by embedded FinTech and #BaaS (banking as a service) solutions, technology capabilities and digital data have exponentially exploded, but the average cost of a mortgage loan has risen to over $10,000 (compared with 2010 at $4,500).

Taken individually, each of the changes significantly alter the lending landscape—yet taken holistically, do they represent a step-function shift? Will derogatory labels seeking to discount the multifaceted impacts of the future—e.g., academic, unconventional, progressive—really negate competition?

Second: What are the Differences Between Traditional and Next-Generational Solutions?

For the mortgage industry, it has arrived at a cliff, a fork-in-the-road if you will, where the business-as-usual (#BAU) practices of the past will be less effective and relevant as markets shift and favor those embracing #E2E (end-to-end) digital solutions. There will be firms who stay-the-course, and others that will move beyond today’s practices by leveraging data and distributed cloud solutions to shorten mortgage costs and timeframes.

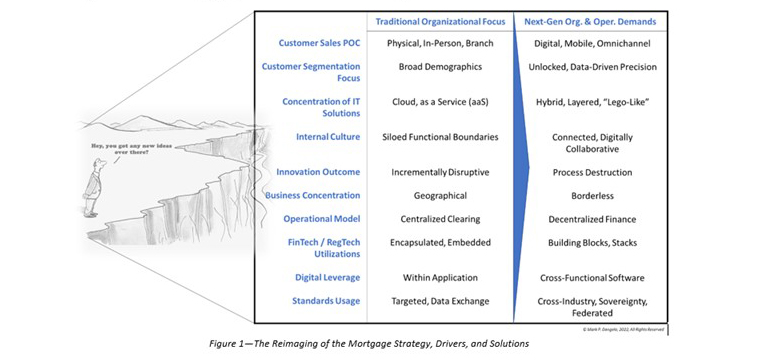

Moreover, new research shows that by leveraging trusted data across the existing 82 loan processes (i.e., customer contact through secondary markets) which consume an average of 45 to 85 days, the digital streamlining incorporating trusted tasks (and their data) eliminates over 30 processes and shortens timeframes by up to 66%. The shift from the traditional drivers, strategy, and solutions to the next generation of mortgage operations is illustrated in Figure 1.

As illustrated in Figure 1, to stay the current course requires incremental automation commitments against shrinking returns, while those organizations with the next-generation digital vision, capital, and partnerships will dominate future markets. The challenge for many traditional mortgage lenders and their IT vendors and support staffs will be not just the terminology, but also the implications of what it requires to adopt and adapt to these Next-Gen solutions.

Yet, with traditional mindsets influencing our current choices and operational experiences, questions of how to proactively address the interconnected business drivers likely fall within buckets of “what we know” versus “what is possible?” These both are then contrasted against “what is necessary to compete?” It is this latter question that should keep mortgage leaders focused against unfamiliar markets, competitors, and digital demands. But is this all there is? What else should be examined and accounted for as the market rebalances and the mortgage products and services are reimaged?

Third: What Else? Touchpoints? Ecosystems? Really?

In the end, the result will be that the mortgage industry will fracture into at least two operational models; a) firms that without capital, skills, and leadership will marginally meet consumer and investor demands, and b) organizations that adapt to an end-to-end digital customer and investor product which transcends origination, servicing and secondary touchpoints.

Furthermore, fueled by a decade of downstream #IT impacts supercharged by two years of pandemic operating requirements, the full embrace of digitization and application solutions changed the relationships between customers and their financial products and services.

Now in a short span of six months, risks and behaviors mutating underneath historic economic pressures are challenging leadership convictions. Once “proven” operating models and innovation investments are suffering under market pains, sweeping M&A events, and rumored Fintech cullings coming into focus. Will the traditional ideals and practices guide them through the challenges, or will they force them into situations and arrangements that remake an industry?

To compete within a commodity market while establishing meaningful differentiations, emerging industry leaders are embracing the idea of a “mortgage machine” of parts, much like manufacturing. These “parts and specialty machines” are designed to interact with one another and linked by data standards and anticipated digital outcomes. To guarantee customer fit while creating trust (which limits rework and data sourcing), E2E “fabrics” of digital information are being created utilizing proven techniques adapted from disciplines such as supply chain management and industries such as retail.

In 2022-2025, executive vision aligned with digital delivery results will be highly sought-after leadership and transformation skills. With digitization commonplace coupled across the design and deployment of multiplatform digital fabrics, financial and mortgage leaders are shifting their attention from incremental competitive advantages to reimaging the mortgage process to fit the changing realities of consumers, technologies and investors. Why now? Why are these Next Gen demands so unfamiliar?

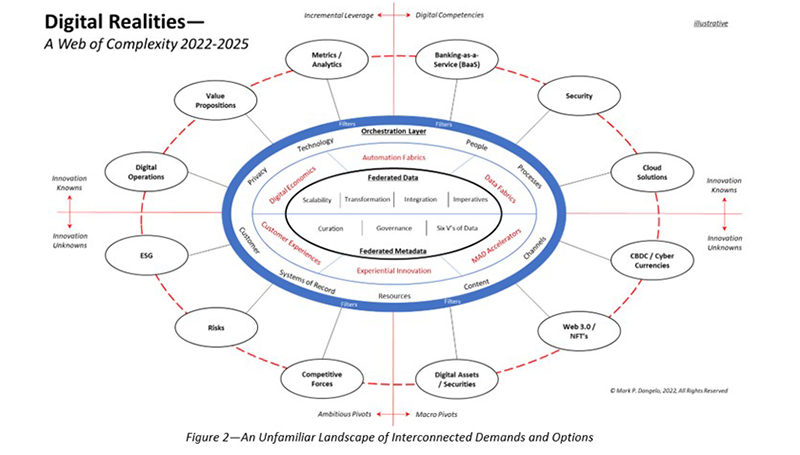

To address why the reimaged mortgage market will bifurcate can be shown in the illustration of Figure 2. What we notice across this diagram are emerging solutions coupled with traditional ideals. The software and apps powering the exponential data growth are now being stitched together to form fabrics of digital information that accurately reflect consumer behaviors and potential market opportunities within areas of householding and cross-selling (both traditional banking principles).

Yet, when blended with emerging solutions like CBDC (central bank digital currencies) and cryptocurrency, cross-border payments and settlements, BaaS, and even the much-hyped Metaverse, the processes and information flows resemble a digital Tower of Babble for many traditional providers.

The next three years encompassing the digital complexities (e.g., integration of federated data metadata) showcased in Figure 2 are based on what is happening—what is already in play. While the industry is transfixed on the outcome of #ICE and their overall #MAD strategy and platform leverage, there are events taking place outside of the traditional players that merit a brief mention.

Digital sovereignty is another building block that has yet to transcend the U.S. shores with critical innovations coming from pioneers such as #Dataswift. These firms and their “stackable solutions” will place IT and business architects in industry spotlights due to their mastery of rapid-cycle, customer-focused innovations which last for weeks and months—not the years common with traditional implementations. What else would you include, exclude and discount? Would your customers (and future ones) agree with your decision based on tradition, what we know, what is possible, or what is competitive?

Fourth, How Will it Fit for Us?

As industry leaders contemplate their next steps hoping to curtail non-traditional competitive pressures, the goal of a “customer for life” takes on an urgency that differentiates them from competitors who view mortgage industry as a set of transactions. Yet, because of the Great Recession, mortgage products and services have been squarely encased by technology expansions designed to improve the quality and digital information of the underlying asset. Investments of technology and processes were rationally made to serve traditional practices.

The implications of modernization implementations during this last decade of “automation @scale” has resulted in streams of digital information or digital supply chains. From customer contact to loan processing to servicing to securitization, all aspects of the process have been focused on volume and accuracy especially for conforming loans.

The net of these strategies and outcomes is why we can reinvent the mortgage industry in the face of non-traditional competition and the embrace of “Amazonian” data strategies. The fundamental capabilities to reimage the mortgage ecosystem are already in place or actively being developed—they just have not been assembled across a web of complexities (see Figure 2), nor articulated as competitively distinctive (see Figure 1).

What is becoming obvious in the digital implementations demanded by the consumer is that traditional mindsets of prescriptions are increasingly being marginalized. Digital financial products enabled by the last decade of paper-transaction automation has firmly moved financial services and mortgage firms into customer technology enablers—not payment processors, not loan originators, and not one-size-fits-all financial firms. It has been an avalanche of subtle shifts transpiring for the last 12 years.

Now the shift has begun towards a Next-Gen ecosystem for firms who recognize that digital has comprehensively transformed customers and investors. The consumption of digital products will be all there is when it comes to financial services where the solutions are assembled as Baas, embedded finance, or as part of a mortgage digital supply chain. Make no mistake, the rise of digital is permanent. The consumer shift to digital is “so last year.”

And, with the markets rebalancing as we head into conference season, there will be sessions seeking to establish a way forward across these “academic,” complex, unfamiliar discussions on “How has it come to this?” The answers to these types of questions are self-evident. The real opportunities are now in “What will the reimage of the mortgage industry be and how can we align ourselves for success?”

Then ask yourself, “who will the faces be in the conference crowds in the coming months and years as these next phases and steps unfold?” Will you be one of them?

(Views expressed in this article do not necessarily reflect policy of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Mike Sorohan, editor, at msorohan@mba.org; or Michael Tucker, editorial manager, at mtucker@mba.org.)