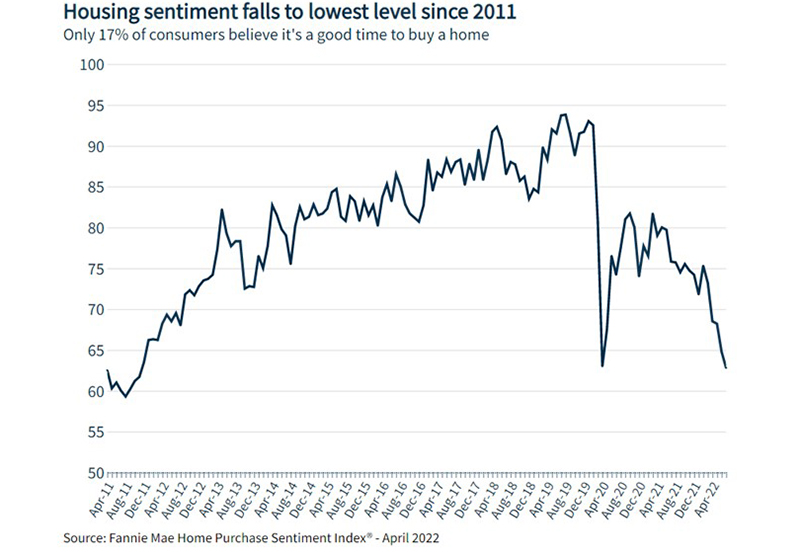

Fannie Mae: Consumer Sentiment Toward Housing at 11-Year Low

Fannie Mae, Washington, D.C., said its Home Purchase Sentiment Index fell by two points in July to 62.8, its lowest level since 2011 and well below the record high set in 2019.

The survey reported consumers continue to express pessimism about homebuying conditions, with only 17% of respondents reporting it’s a good time to buy a home. Meanwhile, the percentage of consumers believing it’s a good time to sell has begun ticking downward in recent months, falling from 76% in May to 67% in July. Overall, four of the index’s six components decreased month over month, including the component associated with home price growth expectations, which has fallen “meaningfully” over the past few months but remains positive on net. Year over year, the full index is down 13.0 points.

“The HPSI has declined steadily for much of the year, as higher mortgage rates continue to take a toll on housing affordability,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist. “Unfavorable mortgage rates have been increasingly cited by consumers as a top reason behind the growing perception that it’s a bad time to buy, as well as sell, a home. Additionally, consumers appear to be indicating that selling conditions are softening, as the ‘Good Time to Sell’ component has declined meaningfully over the past two months, and, on net, fewer consumers expect home prices to go up.

Duncan said with home price growth slowing, and projected to slow further, consumer reaction to current housing conditions is likely to be increasingly mixed. “Some homeowners may opt to list their homes sooner to take advantage of perceived high prices, while some potential homebuyers may choose to postpone their purchase decision believing that home prices may drop,” he said. “Overall, this month’s HPSI results appear to confirm our forecast for moderating home sales over the coming year.”

Other key survey findings:

• Good/Bad Time to Buy: The percentage of respondents who say it is a good time to buy a home decreased from 20% to 17%, while the percentage who say it is a bad time to buy increased from 75% to 76%.

• Good/Bad Time to Sell: The percentage of respondents who say it is a good time to sell a home decreased from 68% to 67%, while the percentage who say it’s a bad time to sell increased from 26% to 27%.

• Home Price Expectations: The percentage of respondents who say home prices will go up in the next 12 months decreased from 44% to 39%, while the percentage who say home prices will go down increased from 27% to 30%. The share who think home prices will stay the same increased from 23% to 26%.

• Mortgage Rate Expectations: The percentage of respondents who say mortgage rates will go down in the next 12 months increased from 5% to 6%, while the percentage who expect mortgage rates to go up remained unchanged at 67%. The share who think mortgage rates will stay the same remained unchanged at 21%.

• Job Loss Concern: The percentage of respondents who say they are not concerned about losing their job in the next 12 months remained unchanged at 78%, while the percentage who say they are concerned increased from 21% to 22%.

• Household Income: The percentage of respondents who say their household income is significantly higher than it was 12 months ago decreased from 25% to 24%, while the percentage who say their household income is significantly lower decreased from 16% to 13%. The percentage who say their household income is about the same increased from 58% to 61%.