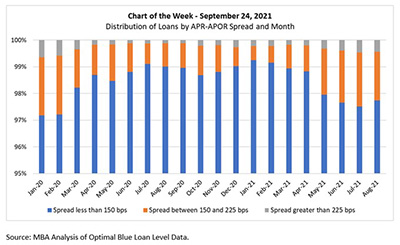

MBA Chart of the Week, Sept. 24, 2021: Distribution of Loans by APR-APOR Spread & Month

Under the Ability-to-Repay/Qualified Mortgage rule, loans that meet the rule’s requirements for QMs obtain certain protections from liability. In December 2020, the Consumer Financial Protection Bureau revised the rule implementing the ATR (with an additional delay announced in April) so that a first-lien loan meets the General QM loan definition only if the annual percentage rate exceeds the average prime offer rate for a comparable transaction by less than 2.25 percentage points as of the date the interest rate is determined (setting aside the continued ability to use Appendix Q to qualify loans through September 2022).

For a safe harbor general QM loan, the spread between the APR and the APOR must not exceed 1.5 percentage points for a first lien. For a rebuttable presumption of compliance, the spread between APR and APOR for first-lien mortgages may exceed 1.5 percentage points, but it is limited to 2.25 percentage points under the revised final rule.

In this week’s MBA Chart of the Week, we analyze Optimal Blue single-family, 30-year fixed mortgage rate origination loan data from January 2020 through August 2021. We further group loans in the chart by the spread between their reported note rate and the (monthly average of the) Freddie Mac Primary Mortgage Market Survey rates to approximate the APR-APOR spread.

The chart shows that over the 20 months, between 97.2% and 99.2% of the loans had an APR-APOR spread less than 1.5%. In other words, 98.5% of the loans analyzed, on average, would likely have been classified as safe harbor under the revised rule. Additionally, 1.2% had a spread between 1.5% and 2.25% (rebuttable presumption), and only 0.3% had a spread greater than 2.25%.

Due to the potential risk from an ATR rule violation, many lenders have preferred to stay within the confines of safe harbor QM lending. Those who have a greater willingness to offer non-QM products may charge higher rates to offset the risk, even to creditworthy borrowers. This has resulted in much lower credit availability, despite stronger economic and employment conditions. Our Mortgage Credit Availability Index shows that despite recent upticks in the index, credit availability, is still close to 2014 lows.

- Mike Fratantoni (mfratantoni@mba.org), Edward Seiler (eseiler@mba.org), Joel Kan (jkan@mba.org)