MBA Advocacy Update Sept. 24, 2021

On Tuesday, House lawmakers passed a continuing resolution along party lines, sending the measure to the Senate for a vote ahead of a Sept. 30 government funding deadline. Meanwhile, MBA led a coalition of associations urging Congress to raise the federal debt limit to avoid roiling financial markets. And MBA’s Research Institute for Housing America released a report that examines climate change’s growing impact on housing and housing finance.

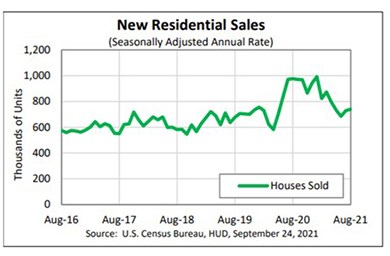

August New Home Sales Pick Up the Pace

New home sales rose in August for the second straight month and at the fastest pace since April, HUD and the Census Bureau reported Friday.

Affordable Housing Vacancy Rates Remain Tight

The national vacancy rate for Low-Income Housing Tax Credit-supported affordable housing dipped 0.1 percent in the second quarter to 2.5 percent, said Moody’s Analytics REIS, New York.

FHFA Extends COVID-19 Multifamily Forbearance

The Federal Housing Finance Agency said Fannie Mae and Freddie Mac will continue to offer COVID-19 forbearance to qualifying multifamily property owners as needed, subject to tenant protections the agency imposed during the pandemic.

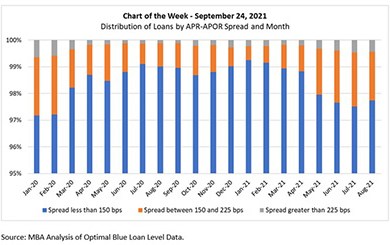

MBA Chart of the Week, Sept. 24, 2021: Distribution of Loans by APR-APOR Spread & Month

In this week’s MBA Chart of the Week, we analyze Optimal Blue single-family, 30-year fixed mortgage rate origination loan data from January 2020 through August 2021. We further group loans in the chart by the spread between their reported note rate and the (monthly average of the) Freddie Mac Primary Mortgage Market Survey rates to approximate the APR-APOR spread.