BREAKING NEWS

Applications Fall in MBA Weekly Survey

Mortgage rates fell last week—but so did mortgage applications, refinance applications in particular, the Mortgage Bankers Association reported in its Weekly Mortgage Applications Survey for the week ending October 29.

The Mortgage Bankers Association and nearly two dozen industry trade groups urged members of the Senate Banking Committee to support federal legislation to address “tough legacy” contracts that currently reference LIBOR.

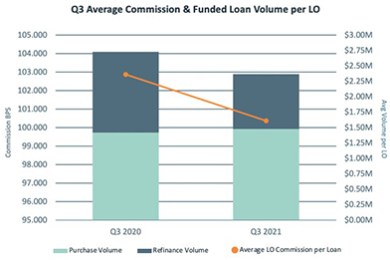

SimpleNexus, Lehi, Utah, said declining loan volumes in the third quarter pushed quarterly loan originator commission earnings by 17%.

The Consumer Financial Protection Bureau released research reporting consumers in majority Black and Hispanic neighborhoods, as well as younger consumers and those with low credit scores, are far more likely to have disputes appear on their credit reports.

The credit card industry is rebounding strongly from the early impacts of the COVID-19 pandemic, said TransUnion, Chicago, with Gen Z leading the way in terms of originations and bankcard balance growth and other credit categories, including mortgage.

The Bascom Group LLC, Irvine, Calif., acquired a 216-unit multifamily community and a 93-unit single-family rental portfolio in Las Vegas for $74.3 million.

While Rural Development's requirements lack details specific to the content of the security instruments used, they do have plenty of other requirements regarding the servicing of a loan which may not be completely compatible with the covenants within the SIs. The following summarizes the types of conflicts, additional requirements and near conflicts that may exist

While there are more tools, technology advancements, access to data and specific programs tailored to minority consumers and marginalized groups than ever before, there are still additional steps the industry can take to truly make homeownership a reality for all.

Cherry Creek Mortgage, Denver, promoted Susan Vick to Vice President of Marketing.

Against the background of plummeting refinance activity, there has been a growing level of competition to service limited loan volume. Coupled with the tighter business conditions, market norms have rapidly changed, and so have the borrower profile. These changes have been encouraging lenders to consider getting into the Non-QM space to ensure smooth business continuity.

The Mortgage Bankers Association’s Servicing Solutions Conference & Expo 2022 takes place Feb. 22-25 at the Hyatt Regency Orlando.

Loans in forbearance fell to a new post-pandemic low, with the share of Fannie Mae/Freddie Mac loans in forbearance falling under 1%, the Mortgage Bankers Association reported Monday.