Gen Z Drives Strong Q3 Credit Activity

The credit card industry is rebounding strongly from the early impacts of the COVID-19 pandemic, said TransUnion, Chicago, with Gen Z leading the way in terms of originations and bankcard balance growth and other credit categories, including mortgage.

The company’s third quarter Credit Industry Insights Report also found that this youngest generation of consumers are performing well on these credit products.

During the height of the pandemic in mid-2020, card issuers pulled back and tightened new card volume. Since then, credit card originations have nearly doubled – increasing from 8.6 million in Q2 2020 to a record 19.3 million in Q2 2021. The return in consumer demand was most pronounced for Gen Z as the share of originations increased to 14.2%, a jump from 13.3% last year and 9.5% just two years prior.

“Similar to previous generations, as more Gen Z consumers come of age they are actively expanding their credit products across the wallet. For most consumers, the first credit product of choice tends to be a credit card,” said Matt Komos, vice president of research and consulting at TransUnion. “As we enter this new phase of the pandemic where accommodation programs are not as prevalent and liquidity sources such as stimulus funds are drying up, it is a natural next step for consumers to reassess their current credit obligations and apply for new forms of credit – especially if access to credit was minimal in the first place.”

On top of the record level of credit card originations is a return to consumer spending, particularly among the younger generations. In the third quarter, Gen Z average balance per consumer increased 13.9% year over year – the only generation with two consecutive quarters of growth. Millennials also showed average balance growth per consumer with a 1.8% year over year increase.

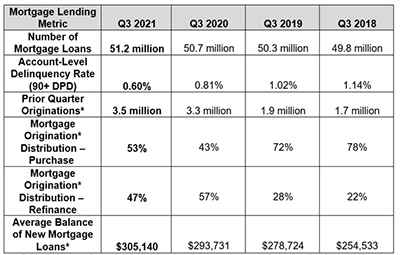

On the mortgage side, TransUnion noted for the first time since the start of the pandemic, new home purchases accounted for the bulk of origination volume, growing from 43% share in Q2 2020 to 53% share in Q2 2021 and outpacing refinances. This reversal was driven by slowed refinance demand, especially with Rate and Term refinancing, which decreased 23% YoY.

Overall, TransUnion said mortgage originations are continuing to grow – albeit at a slower rate than previous quarters – with a 7% YoY increase in volume during Q2 2021, down significantly from the 76% YoY growth seen in the same period last year. Among origination loan types, FHA and Jumbo loans grew at the fastest rate (+16% and +37%, respectively). Total mortgage balances grew 8% YoY to a high of $10.5 trillion in Q3 2021 while the average new loan amount increased 4% YoY to over $305,000 – the result of low inventory, high consumer demand and rising home prices.

“Following several quarters of hyper growth, activity in the mortgage market has started to slow,” said Joe Mellman, Senior Vice President and Mortgage Business Leader with TransUnion. “We expect the trend of home purchases to continue to overtake refinance, especially if consumer demand for homes stays strong and inventory improves. This is assuming mortgage rates continue to rise, which will cause refinances to decline. At a generational level, origination growth was most pronounced for Gen Z consumers and we expect this to continue as that generation ages and they look to enter the housing market and become home buyers for the first time.”