BREAKING NEWS

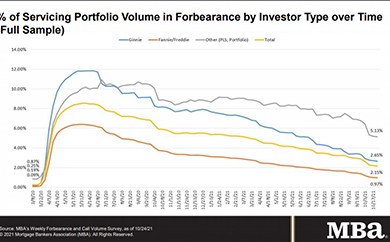

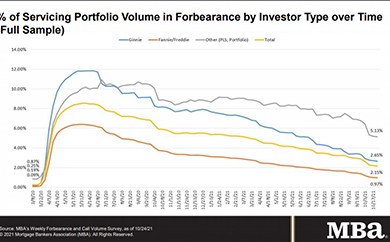

Loans in Forbearance Fall to 2.15%

Loans in forbearance fell to a new post-pandemic low, with the share of Fannie Mae/Freddie Mac loans in forbearance falling under 1%, the Mortgage Bankers Association reported Monday.

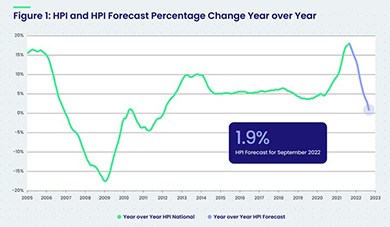

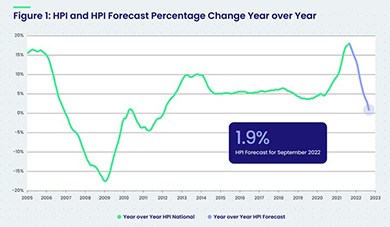

Demand for homebuying remained strong in September, said CoreLogic, Irvine, Calif., with limited housing supply creating challenges for those looking for homes.

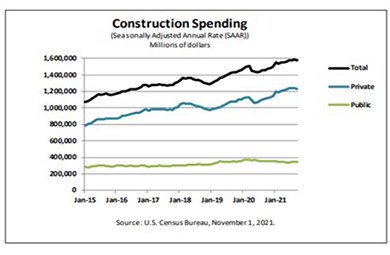

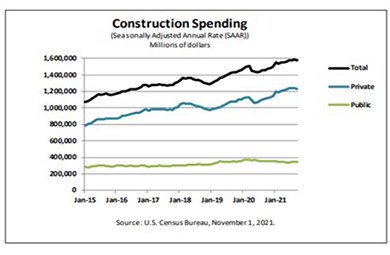

Construction spending, while up year over year, continues to be hampered by building materials shortages and difficulties finding labor, the Census Bureau reported Monday.

Commercial real estate prices continue to increase, according to new reports from Real Capital Analytics and CoStar.

Cherry Creek Mortgage, Denver, promoted Susan Vick to Vice President of Marketing.

M&T Realty Capital Corp., Baltimore, closed $14.6 million in agency and life company loans for three New York multifamily properties.

While there are more tools, technology advancements, access to data and specific programs tailored to minority consumers and marginalized groups than ever before, there are still additional steps the industry can take to truly make homeownership a reality for all.

The Mortgage Bankers Association's Accounting & Financial Management Conference takes place Nov. 10-12 at the Grand Hyatt Nashville.

Against the background of plummeting refinance activity, there has been a growing level of competition to service limited loan volume. Coupled with the tighter business conditions, market norms have rapidly changed, and so have the borrower profile. These changes have been encouraging lenders to consider getting into the Non-QM space to ensure smooth business continuity.

It’s not often the mortgage industry plays coy when it comes to certain topics, but currently, there are rumblings about the T-word – tapering. There's a couple of misconceptions about tapering and what that might mean, especially for mortgages and mortgage-backed securities. Let’s clear those up.

This week’s MBA Chart of the Week shows FHFA’s quarterly, non-seasonally adjusted year-over-year HPA starting from the fourth quarter of 2008 through the second quarter of 2021, together with MBA’s quarterly forecast through the end of 2024.

MBA submitted recommendations to FHFA in response to its RFI on the new Equitable Housing Finance Plans required of the GSEs, as well as on FHFA’s proposed housing goals for the GSEs. MBA also submitted a comment letter and signed onto a joint comment letter to the OCC in response to the Agency’s proposal to rescind its June 2020 CRA Rule.