Commercial Property Price Growth Accelerates

Commercial real estate prices continue to increase, according to new reports from Real Capital Analytics and CoStar.

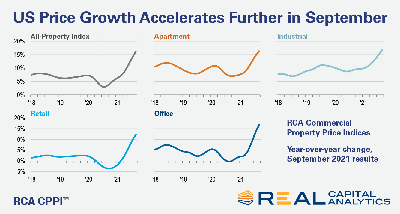

Real Capital Analytics Senior Analyst Michael Savino said the headline rate of U.S. property price growth accelerated further in September, “propelled by faster rates of growth from all four major property types.”

The RCA all-property index rose 2.2 percent in August to a point 16.1 percent above a year ago.

Savino noted the office sector index accelerated to a record 16.9 percent year-over-year rate in September, “overtaking apartment and on par with the industrial sector.” Suburban office prices powered the gain by climbing 20.2 percent year-over-year while central business district office prices fell 1.2 percent.

Apartment prices have increased 16.3 percent over the past 12 months and industrial prices climbed 16.9 percent. “Both are the fastest rates seen since the inception of the RCA price index in 2000,” Savino. Retail property prices increased 12.4 percent.

Examining data for the entire third quarter, CoStar, Washington, D.C., said its value-weighted price index, which tracks high-value trades, rose 6.1 percent during the quarter, compared to a 3.8 percent gain in the second quarter. The index is now 10.4 percent higher than its pre-pandemic level.

The CoStar equal-weighted price index, which tracks the more numerous but lower-priced property sales typically seen in secondary and tertiary markets, increased 3.8 percent in third quarter. This index now stands 14.9 percent above its pre-pandemic level.

CoStar noted the hospitality sector saw healthy price growth for the second consecutive quarter between July and September after a very challenging pandemic period. The sector saw a 4.4 percent increase in the third quarter, the fastest quarterly gain of any property type. It remains 1.5 percent below its year-ago level and 4.2 percent below its pre-pandemic level.

Commercial property sales also surged to new highs in the third quarter, fueled by individual asset sales in the apartment and industrial sectors, RCA said.

Deal volume surpassed $450 billion for the first three quarters of the year, a new record. “The last time deal volume approached this mark was 2007, when entity-level deals in the office and retail sectors bolstered total activity,” RCA said in its U.S. Capital Trends report.

The apartment and industrial sectors together made up nearly 60 percent of total sales activity, RCA reported. “It was a record quarter for apartment deal volume, with the quarterly total higher than the average annual totals for the sector from 2008 to 2011,” the report said. “In the industrial sector, year-to-date [sales] activity set a new high.”