Share of Mortgage Loans in Forbearance Drops to 2.15%

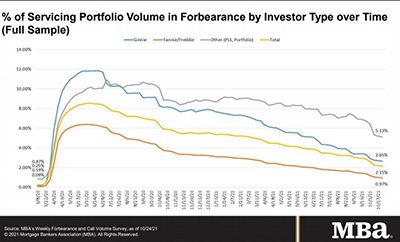

Loans in forbearance fell to a new post-pandemic low, with the share of Fannie Mae/Freddie Mac loans in forbearance falling under 1%, the Mortgage Bankers Association reported Monday.

The latest MBA Forbearance and Call Volume Survey reported loans in forbearance decreased by 6 basis points to 2.15% of servicers’ portfolio volume as of October 24 from 2.21% the prior week. MBA estimates 1.1 million homeowners are in forbearance plans.

The share of Fannie Mae and Freddie Mac loans in forbearance decreased by 3 basis points to 0.97%. Ginnie Mae loans in forbearance decreased by 7 basis points to 2.65%, while the forbearance share for portfolio loans and private-label securities declined by 8 basis points to 5.13%. The percentage of loans in forbearance for independent mortgage bank servicers decreased by 6 basis points to 2.43%, while the percentage of loans in forbearance for depository servicers decreased by 4 basis points to 2.07%.

“For the first time since March 2020, the share of Fannie Mae and Freddie Mac loans in forbearance dropped below 1 percent,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “A small decline for this investor category was matched by similarly small declines for Ginnie Mae and portfolio/PLS loans. Forbearance exits slowed at the end of October to the slowest pace since late August. With so many borrowers having reached the end of their 18-month forbearance term, we expect a steady pace of exits in November.”

Key findings of MBA’s Forbearance and Call Volume Survey – October 18 – 24

- Total loans in forbearance decreased by 6 basis points from 2.21% to 2.15%.

- By investor type, the share of Ginnie Mae loans in forbearance decreased from 2.72% to 2.65%.

- The share of Fannie Mae and Freddie Mac loans in forbearance decreased from 1.00% to 0.97%.

- The share of other loans (e.g., portfolio and PLS loans) in forbearance decreased from 5.21% to 5.13%.

- By stage, 15.6% of total loans in forbearance are in the initial forbearance plan stage, while 74.2% are in a forbearance extension. The remaining 10.2% are forbearance re-entries, including re-entries with extensions.

- Total weekly forbearance requests as a percent of servicing portfolio volume (#) remained the same at 0.04%.

- Of the cumulative forbearance exits for the period from June 1, 2020, through October 24, 2021, at the time of forbearance exit:

- 29.1% resulted in a loan deferral/partial claim.

- 20.6% represented borrowers who continued to make their monthly payments during their forbearance period.

- 16.7% represented borrowers who did not make all of their monthly payments and exited forbearance without a loss mitigation plan in place yet.

- 13.1% resulted in a loan modification or trial loan modification.

- 12.0% resulted in reinstatements, in which past-due amounts are paid back when exiting forbearance.

- 7.1% resulted in loans paid off through either a refinance or by selling the home.

- The remaining 1.4% resulted in repayment plans, short sales, deed-in-lieus or other reasons.

- Weekly servicer call center volume:

- As a percent of servicing portfolio volume (#), calls decreased from 7.7% to 5.9%.

- Average speed to answer decreased from 2.1 minutes to 1.5 minutes.

- Abandonment rates decreased from 5.7% to 4.0%.

- Average call length decreased from 7.9 minutes to 7.8 minutes.

- Loans in forbearance as a share of servicing portfolio volume (#) as of October 24:

- Total: 2.15% (previous week: 2.21%)

- IMBs: 2.43% (previous week: 2.49%)

- Depositories: 2.07% (previous week: 2.11%)

MBA’s latest Forbearance and Call Volume Survey represents 73% of the first-mortgage servicing market (36.7 million loans). To subscribe to the full report, go to www.mba.org/fbsurvey.

If you are a mortgage servicer interested in participating in the survey, email fbsurvey@mba.org.

NOTE: MBA’s last Weekly Forbearance and Call Volume Survey will be released on Monday, November 8, at 4:00 p.m. ET. MBA will move to a monthly report called MBA’s Monthly Loan Monitoring Survey. The first publication of the Monthly Loan Monitoring Survey will cover forbearance and performance data for the period November 1 through November 30, and will be released on Monday, December 20, 2021, at 4:00 p.m. ET.