BREAKING NEWS

Applications Rise Again in MBA Weekly Survey

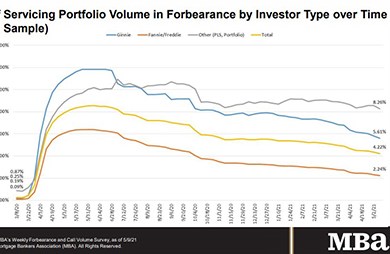

Consumers got on the refinance bus last week, driving mortgage applications up for the second consecutive week, the Mortgage Bankers Association reported Wednesday in its Weekly Mortgage Applications Survey for the week ending May 14.

The Mortgage Bankers Association sent a letter this week to House leadership, urging support for legislation that would allow more appraisers practicing in the field today to become eligible to conduct real estate evaluations on properties subject to mortgages insured by the Federal Housing Administration.

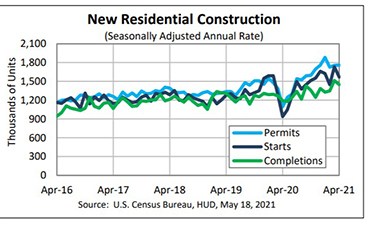

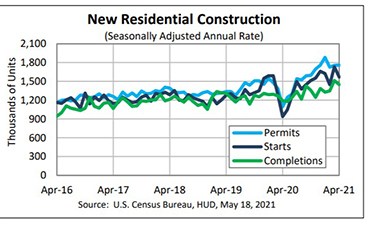

Supply constraints continue to prevent a sizzling housing market from turning white-hot, with April housing starts falling by nearly 10 percent, HUD and the Census Bureau reported Tuesday.

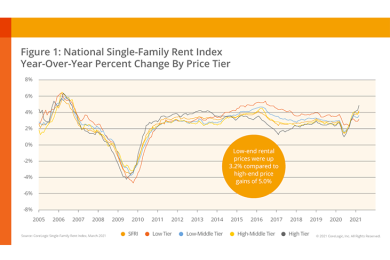

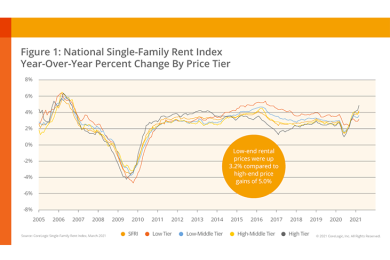

Occupancy rates for single-family rental homes have reached a generational high, driving up SFR rent growth, two new reports said.

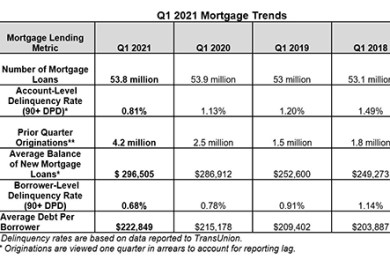

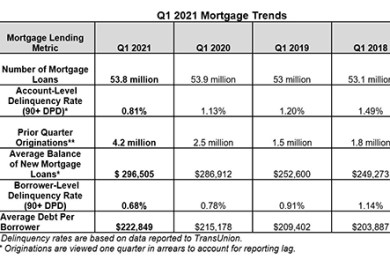

TransUnion, Chicago, said despite shockwaves felt from the COVID-19 pandemic, the consumer credit market is strongly positioned as many parts of the country prepare to enter new phases of re-opening this summer.

Used by more than 25% of the top brokerage firms and more than 15% of the top mortgage originators in the U.S., Adwerx delivers personalized, omnichannel brand marketing and automation at enterprise scale.

JLL Capital Markets, Chicago, secured a $400+ million construction loan for Genesis Marina, a to-be-built waterfront Class A life science campus in Brisbane, Calif.

Joe Zeibert is Managing Director of Global Lending Solutions with Nomis Solutions, Brisbane, Calif. He works closely with clients around the world to identify new mortgage and other consumer lending opportunities.

Significant affordability challenges exist across the country and the issue is a top priority for the Biden Administration. In April, the Mortgage Bankers Association virtually convened business and policy executives for a series of conversations on the 2021 affordable rental housing landscape. Here are some key takeaways from that event.

Gene Ludwig is founder of the Promontory family of companies and CEO of Promontory MortgagePath, a technology-based mortgage fulfillment and solutions company. He is also managing partner of Canapi, a venture capital firm focused on investments in early to growth-stage fintech companies. He was Comptroller of the Currency under President Bill Clinton.

Mortgage servicing has certainly seen ups and downs over the years, although nothing compares to the level of upheaval that we saw last year—nor the speed at which it occurred. Out of the chaos, however, new opportunities to excel have emerged, and perhaps the biggest one of all has been the ability to run a remote workforce with success.

Our three previous articles made the argument for behavioral standards, how to set those expectations, and a valuable response to an LO’s efforts to meet your requirements. Those presentations assumed LOs are willing to change their actions to deliver required results. In this part we address how you might effectively respond when an underperforming LO lacks the motivation to make those changes.

The plethora of aaS over the past decade has within their silos been nothing short of a disruptive phase shift of hardware, network, data, and software consumption. However, what happens when these aaS offerings are merged, stacked, and branched to arrive at containers of agility and innovation all serving rapidly evolving customers and their expectations of how finance should be conducted?