Supply Issues Hold Back April Housing Starts

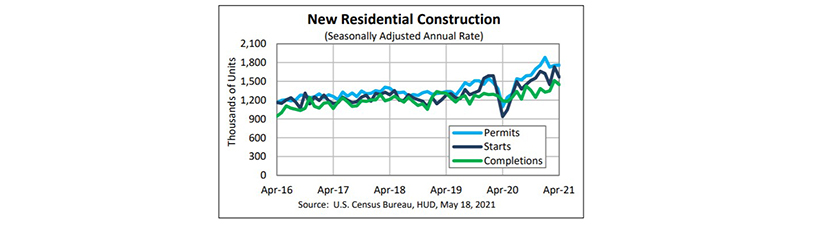

(Chart courtesy U.S. Census Bureau.)

Supply constraints continue to prevent a sizzling housing market from turning white-hot, with April housing starts falling by nearly 10 percent, HUD and the Census Bureau reported Tuesday.

The report said privately owned housing starts in April fell to a seasonally adjusted annual rate of 1,569,000, 9.5 percent below the revised March estimate of 1,733,000, but 67.3 percent higher than a yea ago (938,000). Single‐family housing starts in April fell to 1,087,000; 13.4 percent below the revised March figure of 1,255,000. The April rate for units in buildings with five units or more rose to 470,000, up by 4 percent from March and nearly double the pace of a year ago (97.5 percent).

Regionally, results were mixed, with gains in the West and Northeast more than offset by drops in the South and Midwest. In the South, starts fell by 11.5 percent to 804,000 units in April, seasonally annually adjusted, from 908,000 units in March; from a year ago, however, starts jumped by 41.3 percent. In the Midwest, starts fell by nearly 35 percent in April to 193,000 units from 296,000 units in March but improved by nearly 41 percent from a year ago.

In the West, starts rose by 9 percent in April to 400,000 units, seasonally annually adjusted, from 267,000 units in March and jumped by nearly 120 percent from a year ago. In the Northeast, starts rose by 6.2 percent in April to 172,000 units from 162,000 in March and more than tripled from a year ago (244 percent).

“Single-family starts in April dropped more than 13% compared to last month, but permits to build single-family homes saw a smaller decline. This is consistent with reports that builders are delaying starting new construction because of the marked increase in costs for lumber and other inputs,” said Mike Fratantoni, Chief Economist with the Mortgage Bankers Association. “Moreover, builders are also reporting difficulty obtaining other inputs like appliances. These supply chain constraints are holding back a housing market that should otherwise be picking up speed, given the strong demand for buying fueled by an improving job market and low mortgage rates. Even with these challenges, there are roughly 640,000 new homes under construction right now, a helpful addition to low supply levels.”

“Prior to the pandemic, builders were faced with a lack of construction workers, lack of buildable lots and restrictive regulatory requirements. Those headwinds remain, but now builders must also grapple with surging lumber prices,” said Odeta Kushi, Deputy Chief Economist with First American Financial Corp., Santa Ana, Calif. “The rapid increase in the cost of lumber and supply bottlenecks are increasing the cost of building and delaying projects.”

Both Fratantoni and Kushi noted the increase in housing permits was a bright spot. “This means more construction is in the pipeline,” Kushi said. “The fundamentals driving new home sales are strong – low rates, limited supply of existing homes for sale and demand driven by millennials. The pandemic and the desire for more space has accelerated this lifestyle decision. You can’t buy what’s not for sale, but you can build it.”

Mark Vitner, Senior Economist with Wells Fargo Securities, Charlotte, N.C., said the drop in starts was larger than expected, but only slightly so, and appears to have been amplified by unusually wet weather in the South and Midwest as well as ongoing shortages of lumber and labor. “Despite this past month’s declines, demand for housing, and single-family homes in particular, remains white-hot,” he said. “This is particularly true in the South, which showed uncharacteristic weakness during the month. The weather was a little wetter than usual this spring throughout much of the South, and with lumber, labor and appliances in short supply, many builders appear to have hit the pause button this past month. The number of single-family homes where permits have been authorized but construction has not yet started rose 4% in April and has been trending higher in recent months.”

Vitner said supply shortages present an even greater challenge for builders. “Shortages of lumber, appliances and other building materials have caused many builders to limit the number of homes they started in April,” he said. “The problems appear to be most acute in South, where the number of homes authorized by building permits but not yet started jumped 5.4% to 78,000 units on a seasonally adjusted basis. The backlog of not-yet-started single-family homes has risen 26% since the end of the last year, which should provide strong momentum to home building later this year as supply catches up with demand.”

Doug Duncan, Chief Economist with Fannie Mae, Washington, D.C., noted single-family permits have outpaced starts in three out of the four months in 2021, including in April, with permits declining by a lesser 3.8 percent. “This suggests to us that some of the weakness in starts may be noise, and we expect a partial rebound in the next report,” he said. “However, with measures of housing demand remaining strong and inventories of homes for sale tight, we believe these declines to be somewhat surprising. This report may be the strongest evidence yet that supply constraints, namely lumber and material prices, labor scarcity, and a lack of buildable lots, are weighing meaningfully on homebuilders’ ability to keep up with housing demand.”

The report said privately owned housing units authorized by building permits in April rose to a seasonally adjusted annual rate of 1,760,000, 0.3 percent above the revised March rate of 1,755,000 and 60.9 percent higher than a year ago (1,094,000). Single‐family authorizations in April fell to 1,149,000, 3.8 percent (±1.0 percent) below the revised March figure of 1,194,000. Authorizations of units in buildings with five units or more rose to 559,000 in April, up by 11.1 percent from March and up by 44.4 percent from a year ago.

The report noted privately owned housing completions in April fell to a seasonally adjusted annual rate of 1,449,000, 4.4 percent below the revised March estimate of 1,515,000, but 21.7 percent higher than a year ago (1,191,000). Single‐family housing completions in April rose to 1,045,000 0.1 percent above the revised March rate of 1,044,000. The April rate for units in buildings with five units or more was 401,000, nearly 14 percent lower than March but 26.5 percent higher than a year ago.