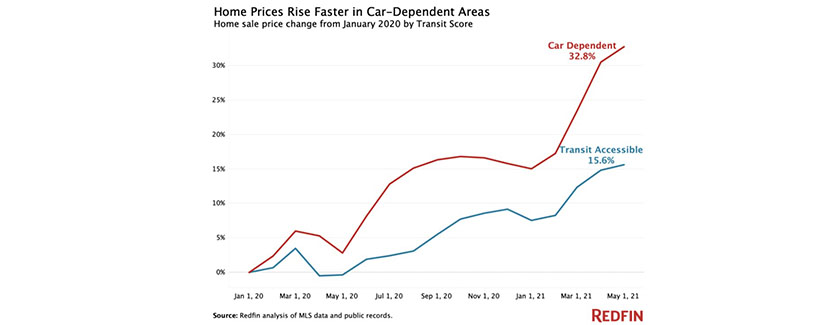

Home Prices Rose Twice as Fast in Car-Dependent Neighborhoods as Transit-Accessible Areas

Home prices in car-dependent areas are up 33% since before the pandemic versus 16% for transit-accessible neighborhoods, according to a new report from Redfin, Seattle, reflecting the rise in remote work and the declining importance of proximity to public transportation.

The disparity arises even as the Mortgage Bankers Association and other trade groups, policymakers and researchers (such as that from the Research Institute for Housing America) tout the importance of access to transit-accessible housing.

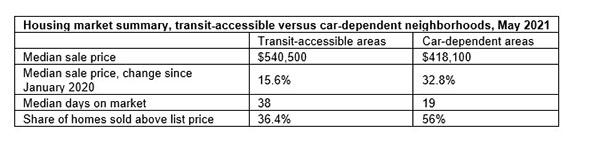

Redfin reported the median home sale price in car-dependent areas nationwide increased by 32.8% to a record $418,100 since January 2020, while it has risen 15.6% to a record $540,500 in transit-accessible neighborhoods.

Both increases are significant, said Redfin Chief Economist Daryl Fairweather, and reflect the uptick in overall demand for homes driven by the pandemic and low mortgage rates. But the outsized price growth since before the pandemic for homes in car-dependent areas—which tend to be suburban and rural rather than urban—signifies the rise of remote work, with house hunters able to prioritize affordability over commute times.

Suburbs, rural areas and small towns have been hot since the beginning of the pandemic, with Redfin.com searches for rural areas and small towns spiking last spring and housing markets in the suburbs heating up more than other neighborhood types throughout 2020.

“Since the start of the pandemic, there has been a huge influx of people moving out here from the Bay Area, and the reason is simple: The houses are bigger and the prices are lower,” said Steven Majourau, a Redfin agent in California’s Central Valley east of San Francisco. “For most people, the tradeoff wouldn’t have been worth it two years ago because of the hours-long commute into San Jose or San Francisco every day, either by train or by car. With remote work, buyers can prioritize the actual home above its proximity to transportation.”

The report found homes in car-dependent neighborhoods are more competitive than those in transit-accessible neighborhoods. Fifty-six percent of homes in car-dependent neighborhoods sold for above asking price in May, versus 36% of transit-accessible homes. The typical home in a car-dependent neighborhood was on the market for 19 days before going under contract, half the time of the typical transit-accessible home (38 days).

“Remote work has allowed many homebuyers to leave cities for far-flung suburbs. Those suburbs often lack public transit, so new residents drive more often,” Fairweather said. “Hopefully, a less frequent commute will mean fewer hours behind the wheel. But as offices reopen, we may see commuters who used to live in the city and use public transit spending more time driving and emitting more carbon. Governments need to plan for this new reality and start providing more green transit to areas outside of major cities.”

To that end, H.R. 7095, the INVEST in America Act, was introduced June 4 by Rep. Peter DeFazio, D-Ore. It addresses provisions related to federal-aid highway, transit, highway safety, motor carrier, research, hazardous materials and rail programs of the Department of Transportation.

In a letter to DeFazio, MBA Senior Vice President of Legislative and Political Affairs Bill Killmer urged support of language from the Build More Housing Near Transit Act, a bipartisan bill with multiple sponsors, which would maximize federal investment in fixed-guideway transit by ensuring the Federal Transit Administration takes a holistic and quantitative approach to evaluating the potential for affordable and market-rate housing development near transit alignments and station areas.

“By making some minor but essential enhancements to the evaluation criteria for the FTA’s Fixed Guideway Capital Investment Grants Program (Section 5309 grants), this provision has the potential to positively impact the availability of housing in transit-served locations across the country,” Killmer said. “While real estate and economic development potential is currently part of the Section 5309 grant evaluation process, each factor is considered individually rather than holistically. This proposal will ensure that projects ripe for affordable housing development are given additional scrutiny.”

And in 2018, the Mortgage Bankers Association’s Research Institute for Housing America released a report that examined land use, specifically, in parking.

The study, Quantified Parking: Comprehensive Parking Inventories for Five Major U.S. Cities (http://www.housingamerica.org), authored by Eric Scharnhorst, Principal Data Scientist with Parkingmill, examined parking inventories in five cities: New York; Philadelphia; Seattle; Des Moines, Iowa; and Jackson, Wyo. Scharnhorst said a “surprising” element noted, particularly in Seattle, is that as land increases in price and surface parking begins to dissolve, the amount of parking in an area may paradoxically increase as parking spaces take shelter in new buildings.

“Today’s empty parking spaces can be seen as a land bank in some of the most convenient city locations, or, taken another way, a future is arriving where builders will be able to provide more of everything else and fewer parking spaces,” Scharnhorst said.

The selected cities revealed some unusual statistics. Parking spaces outnumber homes 27 to one in Jackson. Seattle’s population density of 13 people per acre is less than half its parking density of 29 parking stalls per acre. Philadelphia’s parking density is 3.7 times greater than that of homes. Des Moines has 83,141 households and 1.6 million parking spaces. New York is the only city in the study with more homes than parking—an outcome partially explained by the greater provision of public transit.