MBA Advocacy Update July 12, 2021

MBA submitted recommendations to FHFA last week with respect to the GSEs’ policies addressing eligibility of condominium projects that include short-term rentals. Also last week, Ginnie Mae announced it will continue current measures that allow for the electronic execution and transmission of form HUD 11711A (Release of Security Interest) and form HUD 11711B (Certification and Agreement).

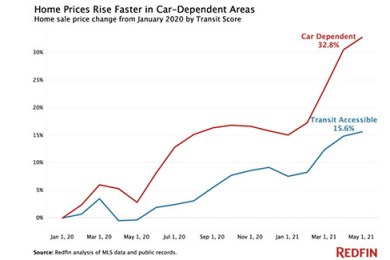

Home Prices Rose Twice as Fast in Car-Dependent Neighborhoods as Transit-Accessible Areas

Home prices in car-dependent areas are up 33% since before the pandemic versus 16% for transit-accessible neighborhoods, according to a new report from Redfin, Seattle, reflecting the rise in remote work and the declining importance of proximity to public transportation.

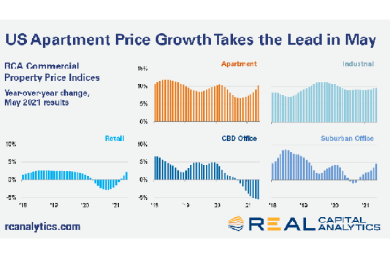

Apartment Property Price Growth Overtakes Industrial

Apartment property prices grew faster than industrial asset prices in June, reversing a trend seen through most of 2021, reported Real Capital Analytics, New York.

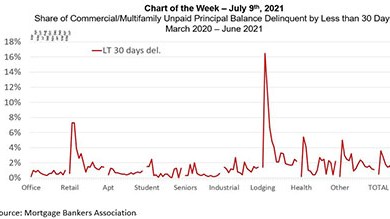

MBA Chart of the Week, July 9, 2021: Commercial/Multifamily Delinquencies

When looking at commercial and multifamily mortgage delinquency rates, we tend to exclude loans that have been delinquent for less than 30 days, as many may be experiencing a temporary “hiccup” that will be quickly remedied before the next payment is due. But examining these rates can provide key insights into commercial and multifamily mortgage performance through the pandemic and into today.