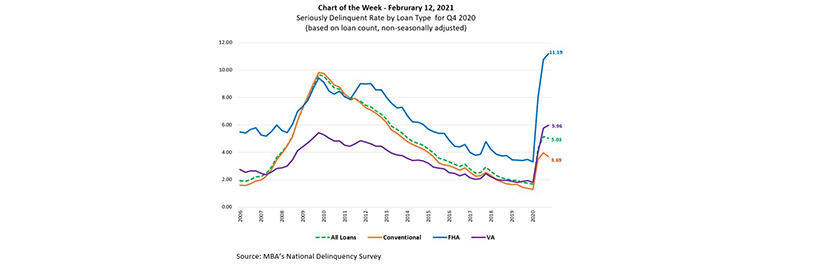

MBA Chart of the Week: NDS Seriously Delinquent Rate By Loan Type

MBA last week released its National Delinquency Survey results for the fourth quarter. The delinquency rate for mortgage loans on one-to-four-unit residential properties at the end of the quarter decreased from a seasonally adjusted rate of 7.65 percent of all loans outstanding in the third quarter to 6.73 percent in the fourth quarter. This 92-basis-point drop in the delinquency rate was the biggest quarterly decline in the history of MBA’s survey dating back to 1979.

The decline in total mortgage delinquencies at the end of 2020 only tells part of the story. As illustrated in this week’s Chart of the Week, the seriously delinquent rate (the percent of loans that are 90 days or more past due or in foreclosure) reached record highs for FHA and VA loans at 11.19 percent and 5.96 percent, respectively. The conventional seriously delinquent rate of 3.69 percent was three times lower than the FHA rate, and over 1.5 times lower than the VA rate.

Delinquencies track closely with unemployment. Borrowers in service industries such as leisure and hospitality are facing longer-term hardships due to the pandemic, and they are more likely to have FHA and VA loans. Mortgage forbearance, foreclosure moratoriums, enhanced unemployment benefits, and stimulus payments have helped distressed homeowners remain in their homes. Additional stimulus and homeowner relief is likely necessary until economic growth picks up later this year.

Anh Doan adoan@mba.org; Marina Walsh, CMB mwalsh@mba.org.