BREAKING NEWS

MBA: Loans in Forbearance Fall to 5.29%; Applications Drop in MBA Weekly Survey

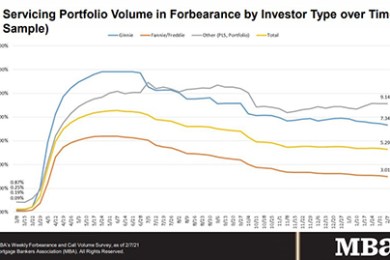

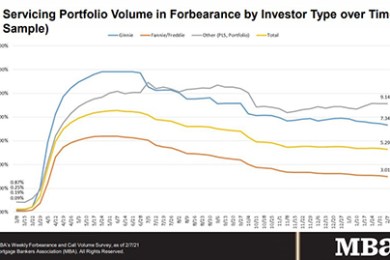

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 5.29% of servicers' portfolio volume as of Feb. 7--the lowest percentage in more than 10 months.

Interest rates hit their highest level since November, and mortgage applications dropped, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending February 12.

The Biden Administration today announced a coordinated extension and expansion of forbearance and foreclosure relief programs. The programs, set to expire at the end of March, have now been extended through June 30.

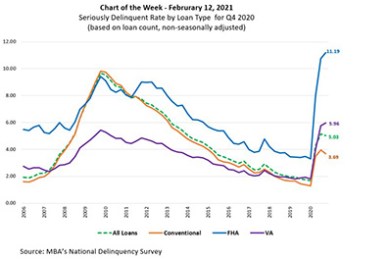

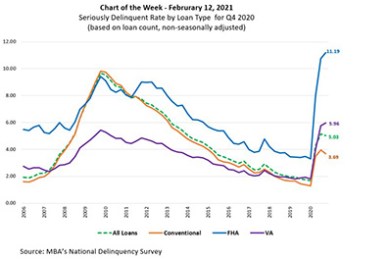

MBA last week released its National Delinquency Survey results for the fourth quarter. The delinquency rate for mortgage loans on one-to-four-unit residential properties at the end of the quarter decreased from a seasonally adjusted rate of 7.65 percent of all loans outstanding in the third quarter to 6.73 percent in the fourth quarter. This 92-basis-point drop in the delinquency rate was the biggest quarterly decline in the history of MBA’s survey dating back to 1979.

Cherry Creek Mortgage, Denver, named Katy Uhl as Chief Human Resources Officer.

KBS, Newport Beach, Calif., completed three refinances totaling $527 million for assets in Chicago, San Jose and Charlotte, N.C.

MBA Newslink interviewed recent MBA Future Leaders Program graduate Dennis Moore about his experiences and perspectives on the current industry landscape and the program.

In this article, we’ll address some of the servicer’s legal requirements and offer three keys to success intended to help servicers manage the post-forbearance process.

Tom Pearce is a co-founder of MAXEX, Atlanta, and serves as its CEO and Chairman of the Board. He brings more than 30 years of expertise within the community banking and insurance arenas as well as expertise within the mortgage finance, credit and asset management arenas.

MBA NewsLink talked with Dane Smith, President of Verus Mortgage Capital, Washington D.C., about why the firm has chosen to work with correspondent lenders to build its portfolio of Non-Qualified Mortgage assets.

As loan servicers continue to battle operational challenges and brace themselves for continuously high volume, there are strategies they should consider to better navigate the changing landscape.

On Thursday, the House Financial Services Committee passed legislation along party lines that includes key housing provisions of President Biden’s $1.9 trillion American Rescue Plan. On Tuesday, the Federal Housing Finance Agency extended its foreclosure and eviction moratorium for Enterprise-backed, single-family mortgages and REO properties through March 31. FHFA also announced it would extend GSE origination flexibilities through March 31.