MBA Chart of the Week: Payment & Employment Characteristics

Last week the Research Institute for Housing America, MBA’s think tank, released updated results that allow us to assess how renters and homeowners fared over the first year-and-a-half of the pandemic.

The updated analysis of the Understanding America Study panel survey data, conducted by Gary Engelhardt of Syracuse University, and Mike Eriksen of the University of Cincinnati, provides close to real-time economic data on the evolving financial consequences of the pandemic. For a summary of the latest results, through October 2021, see MBA’s press release.

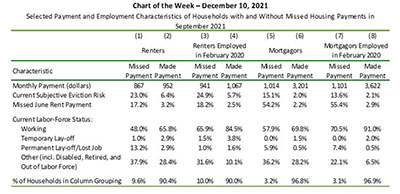

This week’s MBA Chart of the Week zeroes in on selected payment and employment characteristics of households who made and missed their rent and mortgage payments in September. Furthermore, the table shows comparable stats for the subset of renters and mortgagors who were employed in the month before the pandemic (columns (3)-(4) and (7)-(8)).

The table provides many interesting details, but given my limited space, I highlight two. First, the proportion of renters who missed payments in September (9.6% and 10.0% in columns (1) and (3)) was three times larger than the proportion of homeowners who missed mortgage payments (3.2% and 3.1% in columns (5) and (7)). Moreover, the average payment for households who made their September payments was larger (in all four categories) than the average payment of those who missed their September payment. In particular, the average mortgage payment for mortgagors who were employed before the pandemic is 3.3 times larger for those who made their September payment ($3,622) than those who missed it ($1,101).

Second, the proportion of renters and mortgagors who missed their September payment was higher if they had also missed their June payment. For example, while 9.6% of renters missed their September payment, 17.2% missed their September payment if they had also missed their June payment. Among mortgagors, over half of the households who had missed their June payment did not make their September payment. Given that approximately 3% of mortgagors missed their September payment, financial difficulties seem to be concentrated among households who have missed multiple payments.

Unfortunately, the UAS survey on housing-related financial distress during the pandemic was limited during the fall—the frequency of the surveys was reduced and UAS asked fewer questions about missed payments. Given the limited UAS coverage and the ongoing recovery from the pandemic, the update RIHA published last week is the final one in the quarterly series. We thank Professor Engelhardt and Professor Eriksen for their continued support of MBA and RIHA.

–Edward Seiler eseiler@mba.org.