BREAKING NEWS

MBA: Share of Loans in Forbearance Falls to Pre-Pandemic Low 4.90%

The Mortgage Bankers Association, in a letter yesterday to the Consumer Financial Protection Bureau, urged the Bureau not to delay the effective date of its new General Qualified Mortgage Rule, saying the Bureau’s rationale for delaying the rule would not accomplish its stated goals nor benefit consumers.

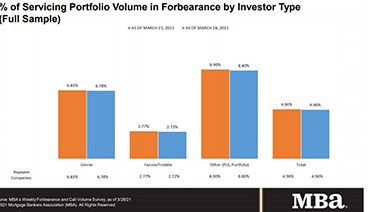

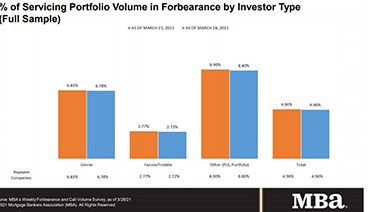

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 6 basis points to 4.90% of servicers’ portfolio volume as of March 28 from 4.90% the prior week--the fifth consecutive weekly drop and the lowest level in more than a year. MBA estimates 2.5 million homeowners remain in forbearance plans.

![]()

The Consumer Financial Protection Bureau yesterday proposed a set of rule changes it said are intended to help prevent “avoidable foreclosures” as emergency federal foreclosure protections expire.

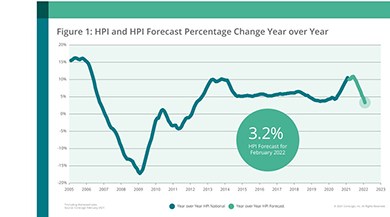

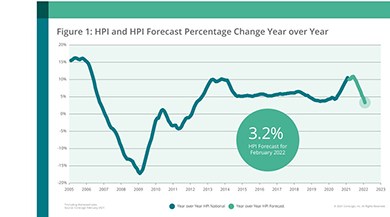

CoreLogic, Irvine, Calif., said supply constraints and buyer demand pushed its monthly Home Price Index to a 15-year high in February.

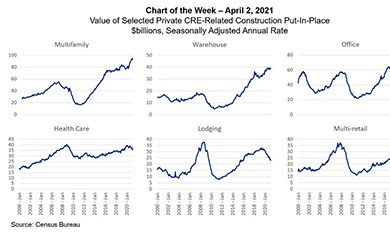

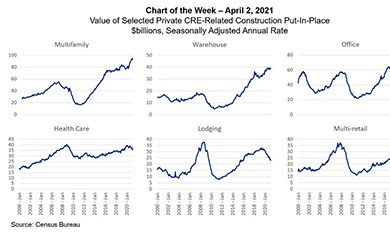

One of the most striking aspects of the COVID-19 pandemic’s impact on commercial and multifamily real estate has been the disparity in the ways different property types have been affected. MBA’s monthly CREF Loan Performance Survey continues to show the immediate and dramatic rise in delinquency rates among lodging and retail properties.

Edgewood Capital Advisors, Southport, Conn., provided an $18.5 million loan to fund the acquisition and entitlement process for a 108-acre infill development site with views of the Columbia River in Vancouver, Wash.

MISMO’s mission is to develop industry standards to solve real estate finance’s thorniest and most pressing business challenges. To make this happen, we drive collaboration across the mortgage industry and draw participation from all facets of the ecosystem.

Loan officers, branch managers, c-level executives and more need access to granular financial data and in-depth accounting tools in a changing market. The pandemic rapidly spurred the adoption of tech solutions and heightened the industry's reliance on technology – from helping lenders operate, to supporting loan officers in their day-to-day tasks, to increasing daily efficiencies for the accounting department.

Cloud computing allows the mortgage ecosystem to no longer be as segmented but rather, exist in a more holistic environment of insights and solutions that deliver a seamless digital experience. Mortgage professionals are already leveraging cloud technology to make smarter, more informed decisions.

Does your company have a process of activities that, when followed, significantly increases a motivated LOs likelihood of success? Well, if your company is like most in this industry, you know the answer to that question.

The domino effect – an endless run of falling dominos winding through the residential home construction industry. That's a vision we can easily conjure up when witnessing the ongoing impacts of steadily rising construction costs. And guess who is at the end of the domino chain, having to deal with the residual mess? Residential home appraisers and their lender clients.

The Mortgage Bankers Association's Commercial Real Estate/Multifamily Finance Board of Governors (COMBOG) Nominating Committee seeks members' recommendations for individuals to serve on the Board beginning this October in the Investor, Lender, Mortgage Banker and Servicer categories.

On Wednesday, President Joe Biden unveiled a $2.3 trillion infrastructure proposal known as the American Jobs Plan, which centers on investing in infrastructure, affordable housing, and green energy – and employs tax policy changes to partially fund the ambitious set of proposed initiatives. On Thursday, the U.S. Supreme Court issued its opinion in Facebook v. Duguid, a dispute concerning the scope of the TCPA’s automatic telephone dialing system definition.