BREAKING NEWS

MBA: Loans in Forbearance Fall to 5-Month Low

![]()

The Mortgage Bankers Association and the National Association of Realtors yesterday sent a letter to House and Senate leaders in opposition to possible legislation that could increase funding fees to veterans’ homeownership benefits.

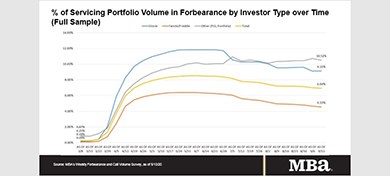

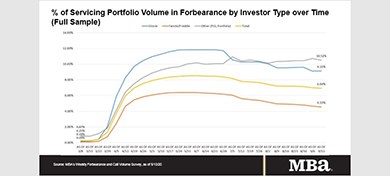

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased by 8 basis points to 6.93% of servicers’ portfolio volume as of Sept. 13, compared to 7.01% the week before. MBA estimates 3.5 million homeowners are in forbearance plans.

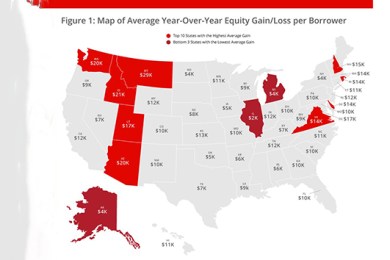

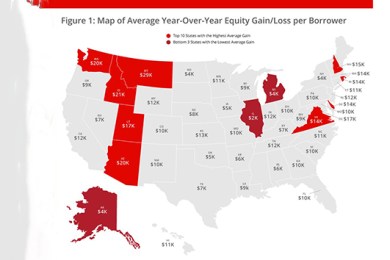

CoreLogic, Irvine, Calif., said its 2nd Quarter Home Equity Report shows U.S. homeowners with mortgages—which account for 63% of all properties—have seen their equity increase by 6.6% year over year. This represents a collective equity gain of $620 billion and an average gain of $9,800 per homeowner from a year ago.

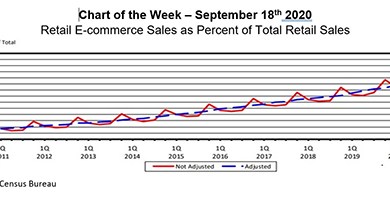

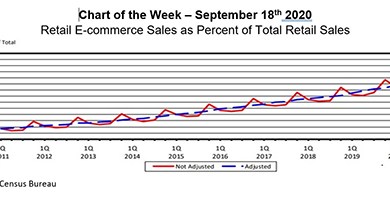

Even before the onset of the pandemic, retail properties were under the microscope. Practitioners spoke about the United States being “over-retailed” compared to other countries, about a shift to experiential retail with a focus on services rather than goods, and about how the rise in e-commerce is a challenge to bricks-and-mortar.

![]()

The Consumer Financial Protection Bureau yesterday said it would extend the comment period on its notice of proposed rulemaking to create a new category of seasoned qualified mortgages by three days, from September 28 to October 1 to accommodate for the Yom Kippur Jewish holiday.

Freddie Mac, McLean, Va., said its Multifamily Apartment Investment Market Index fell by 0.3% in the second quarter following strong previous quarterly gains, reflecting the impact of the coronavirus pandemic and the first negative second quarter net operating income growth since 2009.

Former Ambassador to the United Nations Andrew Young keynotes an important General Session at MBA Annual20, which runs online Oct. 19-21.

The Mortgage Bankers Association is a partner with Nonprofit VOTE in support of National Voter Registration Day, which takes place this Tuesday, Sept. 22.

Even when minorities do become homeowners, research shows that homeownership delivers fewer benefits than it does for white families—including significantly less home equity. Yet there are steps we as an industry can take toward leveling the playing field.

While advice and directions concentrate on the “next normal” inflicted by Covid-19, the underlying challenges facing financial services and banking organizations have been building long before its arrival. If banking and mortgage leadership are to adjust to an altered consumer and investment future, they must quickly determine how to build core competencies with digital leveraging—or risk becoming a statistic.

Cute and customized face masks are wildly popular these days, launching a whole new industry. Closer to home, in our industry, popularity of vendors providing for Remote Online Notarization is surging. Thanks to the pandemic, RON vendors were rather unmasked, going from gaining marginal traction to epic growth – overnight. MISMO is leading the way, with a sharp machete clearing the path through the state level regulatory and compliance jungle.

(One of a continuing series of profiles of participants in the MBA Education Path to Diversity (P2D) Scholarship Program, which enables employees from diverse backgrounds to advance their professional growth and career development.)

A subsidiary of real estate investment trust VICI Properties Inc., Las Vegas, provided Caesars Entertainment, Reno, Nev., a $400 million mortgage secured by the Caesars Forum Conference Center in Las Vegas.