RIHA Study: More than 6 Million Renters and Homeowners and 26 Million Student Debt Borrowers Missed September Payment

More than six million households did not make their rent or mortgage payments, and 26 million individuals missed their student loan payment in September, according to third quarter research released today by the Mortgage Bankers Association’s Research Institute for Housing America.

The new findings offer new insights to the RIHA study, “Housing-Related Financial Distress During the Pandemic,” released in September. During the third quarter, the percent of homeowners and renters behind on their payments decreased slightly from the second quarter, but the overall amount remained high.

In September, 8.5% of renters (2.82 million households) missed, delayed, or reduced payment, while 7.1% (3.37 million homeowners) missed their mortgage payment. The proportion of student debt borrowers who missed a monthly payment has remained steady – at 40% – since May.

“Rent and mortgage payment collections improved over the summer as more people went back to work, but high unemployment continues to place hardships on millions of U.S. households,” said Gary V. Engelhardt, Professor of Economics in the Maxwell School of Citizenship and Public Affairs at Syracuse University. “There is growing concern that absent a slowdown in the number of coronavirus cases and another round of much-needed federal aid, millions of renters in the coming months face the prospects of falling further behind. With the current eviction moratorium expiring in January, the situation could be even more challenging. Many renter households across the country could find themselves with no place to live and no means to repay missed payments.”

Engelhardt noted the tens of millions of student debt borrowers behind on their payments also has future ramifications for the housing and mortgage markets. “A borrower ending up in default would see an adverse effect on their credit, in turn making it potentially more challenging for them to rent or qualify for a mortgage,” he said.

The RIHA research includes data from an innovative household survey from the Understanding America Study, an internet panel survey of over 8,000 households specially tailored to study the impact of the pandemic. Authored by Engelhardt and Michael D. Eriksen, Associate Professor of Real Estate at the University of Cincinnati, the study provides close to real-time economic data on the rapidly evolving financial consequences of the pandemic by following the same set of households from before the outbreak through the end of September.

RIHA Study – Third Quarter Key Findings:

- Receiving unemployment insurance benefits:

- Renters – 3% at the beginning of April to 7% by the end of September

- Mortgagors – 3% at the beginning of April and 3% at the end of September

- Student debt borrowers – rose from 3% at the beginning of April to 8% by the end of September

- Property owners continue to play a key role in helping renters.

- 11% of renters missed one payment over the two quarters, 4% missed two payments, 2.8% missed three payments and 3.8% missed four or more payments.

- 13% of renters received permission from their landlord to delay or reduce their monthly payment (by week).

- In aggregate, rental property owners lost as much as $9.2 billion in third-quarter revenue from missed rent payments.

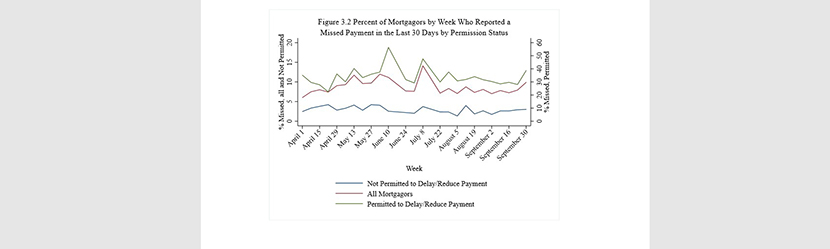

- Mortgagors were the least likely of the three groups to miss a payment during the second and third quarters:

- 4.7% of mortgagors missed one payment over the two quarters, 2% missed two payments, 1.5% missed three payments and 4.2% missed four or more payments.

- Nearly 20% of mortgagors received permission from their lender to delay or reduce their monthly payment (by week).

- In aggregate, total missed mortgage payments were estimated to be as much as $19.4 billion for the third quarter.

- Student debt borrowers were the most likely of the three groups to miss one or more payments.

- 16.2% of student loan borrowers missed one payment over the two quarters, 8.8% missed two payments, 7% missed three payments and 22.7% missed four or more payments.

- The percentage of borrowers reporting missed payments (by month) was 40% in the quarter

- In aggregate, 34.4 million individuals missed at least one student loan payment since the beginning of the pandemic.

- In aggregate, total missed student loan payments were estimated to be as much as $29.5 billion for the third quarter.

“RIHA’s household research on the ongoing impact of the COVID-19 pandemic is providing MBA members, policymakers and consumers with critical, real-time information,” said Edward Seiler, Executive Director of RIHA and MBA Associate Vice President of Housing Economics. “This study reveals the financial distress that many households continue to experience and highlights the need for all stakeholders to come together to provide meaningful solutions to those who will need it most in the coming months.”

RIHA is a 501(c)(3) trust fund. RIHA’s chief purpose is to encourage and assist – through grants to distinguished scholars and subject matter experts, educational institutions, research facilities, and government organizations – establishment of a broader-based knowledge of mortgage banking and real estate finance. Additional studies are available on the RIHA website: http://www.housingamerica.org.