BREAKING NEWS

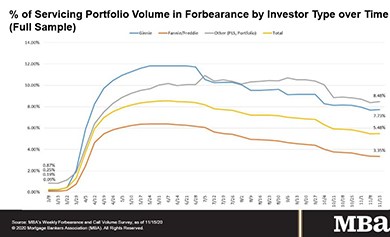

MBA: Rate of Loans in Forbearance Tick Up to 5.48%

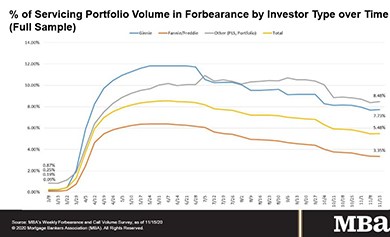

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance increased to 5.48% of mortgage servicers’ portfolio volume as of November 15, from 5.47% the week before. MBA estimates 2.7 million homeowners are in forbearance plans.

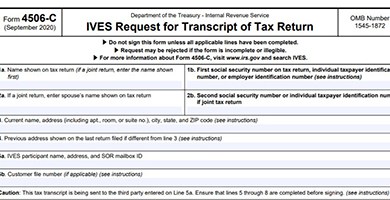

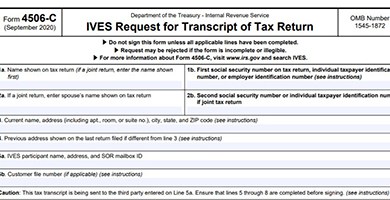

The Internal Revenue Service last week announced changes to the form lenders use to request tax transcripts in its Income Verification Express Service (IVES) Program. The new Form 4506-C supersedes Form 4506-T.

STR, Hendersonville, Tenn., and Tourism Economics, Wayne, Pa., slightly upgraded their final 2020 U.S. hotel forecast, but called full recovery in revenue per available room “unlikely” until 2024.

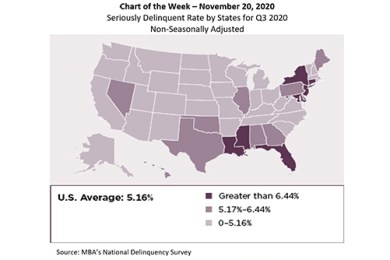

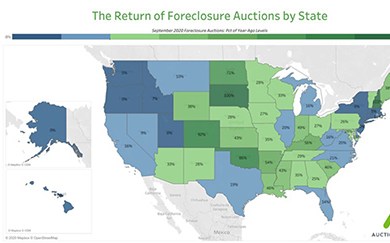

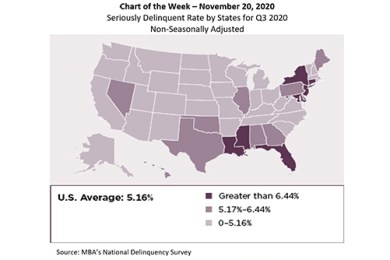

MBA released its National Delinquency Survey results for the third quarter last week. This week’s chart highlights the seriously delinquent rate - the percentage of loans that are 90 days or more delinquent or in the process of foreclosure – in every state across the country.

On Wednesday, the Federal Housing Finance Agency issued a final rule establishing a revised capital framework for Fannie Mae and Freddie Mac. The final capital framework follows an initial proposal put forth by FHFA in 2018, which was re-proposed in 2020.

Selling and delivering as a business partner in today’s market, with Nationwide Title Clearing VP of Sales & Marketing, Danny Byrnes.

Planet Home Lending LLC, Meriden, Conn., promoted Dalila Ramos to Vice President of Talent Acquisition to support recruiting efforts and attract talent.

The MBA Mortgage Action Alliance is accepting nominations for three at-large seats on the 2021-2022 MAA Steering Committee in accordance with the MAA bylaws.

State regulators encourage individuals and businesses that provide mortgage, money transmission, debt collection and consumer financial services to renew their licenses in Nationwide Multistate Licensing System by November 30 to avoid processing delays.

As we investigate 2021, one thing is certain, technology will be the innovation mantra pushing mortgage bankers and their high-touch processes into realities such as straight-through processing. These advanced technical innovations will challenge FSBO’s to think very, very differently.

The shift to digital-first technology has accelerated greatly. Once far on the horizon, digital adoption is no longer an option. Lenders must embrace digital solutions and explore augmented technology to meet consumers where they are and on their own time.

Lenders can reduce the impact of human bias on credit decisioning by building standardized, repeatable and observable processes facilitated by machines. While there’s still value in human interactions, machines are better at ensuring fairness and auditability. You can’t see inside a human mortgage underwriter’s brain, but a computer’s memory leaves a clear trail, making bias easier to measure and safeguard against.

Cushman & Wakefield, Chicago, brokered $45.3 million in Arizona industrial property sales.