IRS Updates Tax Transcript Request Form

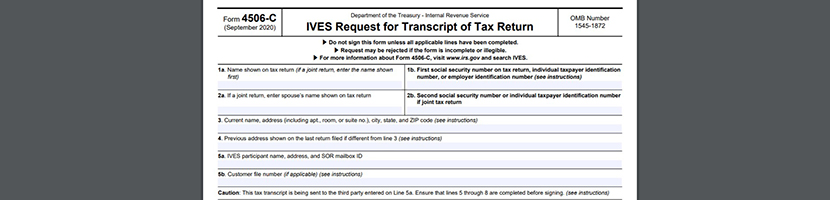

The Internal Revenue Service last week announced changes to the form lenders use to request tax transcripts in its Income Verification Express Service (IVES) Program.

The new Form 4506-C supersedes Form 4506-T. The new form is available for use now; the IRS will permit an overlap period through March 1, 2021; Form 4506-T can be used until Feb. 28, 2021.

However, the Mortgage Bankers Association encourages lenders to make the transition immediately. “Lenders will want to start using the new form as soon as possible, to ensure that pipeline loans and QC requests are not adversely affected,” said Rick Hill, MBA Vice President of Industry Technology. “We encourage lenders to contact their IVES vendor now to begin planning the transition to the new form.”

The Consumer Data Industry Association (https://www.cdiaonline.org/) identifies a few minor differences between the new Form 450-C and the old 4506-T:

- The “Caution” language below Line 5b was updated to be limited for IVES requests. It instructs the taxpayer to make sure that Lines 5 through 8 are complete before signing.

- Date formatting instructions were added for Line 8 entries.

- A field was added below the signature lines to print or type the name(s) of the individual(s) signing the form.

- Notification language for designated recipients and taxpayers was added to advise that a designated recipient will be subject to penalties for unauthorized access, other use, or redisclosure of the taxpayer’s information without the taxpayer’s express permission and authorization.

CDIA also noted Fannie Mae will begin accepting the new form; Freddie Mac is expected to follow suit.

More information can be found at https://www.irs.gov/pub/irs-pdf/f4506c.pdf; questions for the IRS can be sent to wi.ives.participant.assistance@irs.gov.