3rd Quarter Foreclosure Auctions Hit 6-Month High

Auction.com, Irvine, Calif., said completed foreclosure auctions in September increased by24 percent from August to the highest level since the COVID-19 pandemic was declared in March.

Despite the jump, the company’s Q4 2020 Distressed Market Outlook reported completed foreclosure auctions in September were still just 22 percent of year-ago levels — or 78 percent below year-ago levels.

“Foreclosure supply is slowly returning to the market as servicers refine their vacant or abandoned procedures and as states gradually open up,” said Ali Haralson, chief business development officer with Auction.com. “These vacant or abandoned properties, which are exempt from the national foreclosure moratoria on government-backed mortgages, benefit neighborhoods when they are returned to occupancy.”

The report said demand for distressed properties — both at foreclosure auction and for online auctions of bank-owned (REO) properties — hit new multi-year highs during the third quarter. The foreclosure sales rate — the percentage of properties brought to foreclosure auction that sold to a third-party buyer rather than reverting to the lender as REO — increased to a seven-year high of 55.6 percent in September. The average price per square foot for third-party foreclosure auction sales dipped in the third quarter, likely because of the shift to vacant or abandoned properties that often come with more deferred maintenance, but the average price relative to estimated full market value (price execution) increased to a 6.5-year high in September.

“Buyers are showing up in force at the live foreclosure auctions, both in-person at the auction venues and now also virtually,” said Steve Price, SVP of trustee operations with Auction.com.

The report said the average number of bids per REO sold via online auction increased to 12 in September, the highest average bids per REO sold as far back as data is available, September 2012. The increased competition for online REO auctions helped to push the average price per square foot to a record high of $87 in July and average price relative to seller reserve to a record high of 104.5 percent in September.

Data from the Auction.com platform and other industry sources shows a growing backlog of mortgages that are in foreclosure or delinquent but not in a mortgage forbearance program. These mortgages will be those that are most likely to restart or continue the foreclosure process when the nationwide moratoria on government-backed mortgages is lifted.

“We estimate the foreclosure backlog will have grown to more than 1.1 million residential properties by the end of the first quarter of 2021,” said Daren Blomquist, vice president of market economics with Auction.com. “That means we would expect the foreclosure process to start or restart on the mortgages secured by those properties once applicable moratoria are lifted and courts begin to resume foreclosure cases in judicial states. Given the patchwork of state approaches, the return of this backlogged volume will likely be spread over months, if not years.”

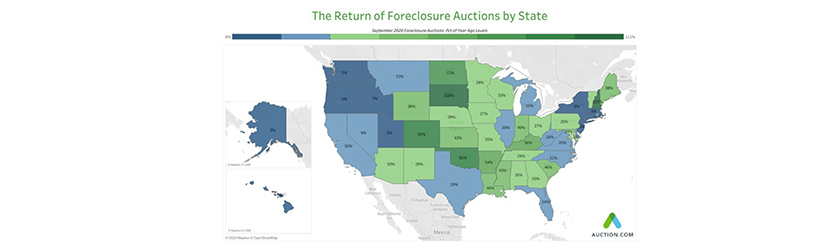

The report said states with an above-average share of year-ago foreclosure volume in September included Colorado (92 percent), Oklahoma (86 percent), Kentucky (56 percent), Arkansas (54 percent) and Indiana (49 percent). States with a below-average share of year-ago foreclosure volume included New York, Oregon and New Jersey (all at 0 percent) along with Washington and Massachusetts (both at 5 percent).