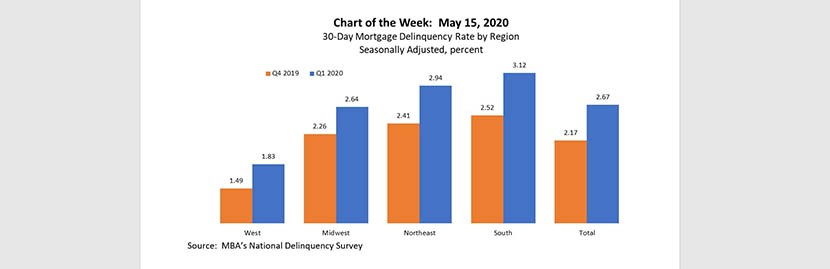

MBA Chart of the Week: 30-Day Mortgage Delinquency Rate by Region

MBA released its latest National Delinquency Survey for first quarter 2020 earlier this week. At the end of the first quarter, the delinquency rate for mortgage loans on one-to-four-unit residential properties jumped by 59 basis points to a seasonally adjusted rate of 4.36 percent of all loans outstanding.

The first quarter’s major variances from fourth quarter 2019 are tied to the increase in early-stage delinquencies resulting from the COVID-19 pandemic. In this week’s chart, we show the change in the 30-day delinquency rate for the nation – as a whole and by geographic region. The national 30-day delinquency rate rose to 2.67 percent, a 50-basis-point increase that matches the hurricane-impacted third quarter 2017 as the highest quarterly increase in the NDS series dating back to 1979.

Among regions, the South and the Northeast experienced the largest basis-point increase in the 30-day delinquency rate compared to the previous quarter, at 60 basis points and 53 basis points, respectively. The Midwest and West reported quarterly increases of 38 basis points and 34 basis points, respectively.

For the West, the increase in the 30-day delinquency rate was the highest quarterly increase in the survey series. For the South, Northeast and Midwest, it was the second-highest quarterly increase ever.

With signs of economic distress continuing into the second quarter, forbearance plans in place for approximately 4 million homeowners (as of May 3), and foreclosure moratoria in effect, 30-day mortgage delinquencies will likely move into later stages of delinquency in coming quarters. The overall delinquency rate can be expected to increase further across all regions.

Note: MBA’s survey asks servicers to report loans in forbearance as delinquent if payment was not made based on the original terms of the mortgage.

Marina Walsh mwalsh@mba.org; Anh Doan adoan@mba.org.