STRATMOR Study Lays Bare Uncertainties of COVID-19 Impact on Housing Market

A study by STRATMOR Group, Greenwood Village, Colo., shows just how quickly and hard hitting the coronavirus pandemic has been on homeowners.

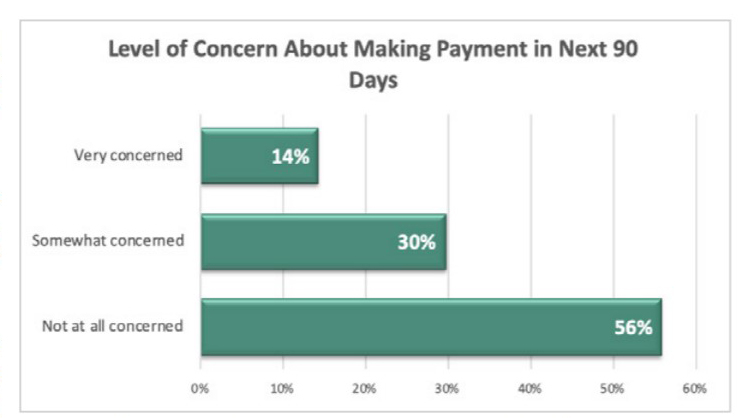

The study of 1,000 homeowners (https://www.stratmorgroup.com/survey-reports/), conducted between Apr. 27-30, showed 44 percent of borrowers are at least somewhat concerned about their ability to make their mortgage payments in the next 90 days.

Even more alarming, the report said, most of them are unclear where to turn for help: 36 percent of borrowers have no knowledge of government assistance programs, while 25 percent are not sure if the government programs apply to them.

“There’s no doubt that the mortgage industry is feeling the effects of the COVID-19 coronavirus,” the report said. “From the time the Fed started cutting rates in March to the rapid and dramatic increase of forbearance requests, lenders and servicers have had to manage a lot of change. And, they have had to manage this change while communicating to consumers who are under their own COVID-19-related stress. For mortgage companies, managing recent changes has been about gauging the pandemic’s financial impact to the entity, and about handling the large influx of refinance loan applications without sacrificing the customer experience.”

STRATMOR Group conducted the study in collaboration with CFI Group, a founding partner of the American Customer Satisfaction Index, collecting feedback from 1,000 homeowners who have mortgages through the nation’s top servicers. The study took place Apr. 27-30 as some states were in the first phase of re-opening for business.

In addition to mortgage-specific questions, the survey asked homeowners about COVID-19’s effect on their work lives and income. The results of this study indicate the level of concern homeowners have with making their mortgage payments and provide insight into the factors impacting the homeowner’s ability to continue making their payments. Additionally, STRATMOR said the study “signals the potential for a significant financial impact to lenders who don’t carefully deal with these consumer concerns.”

Pre-pandemic, 96 percent of respondents report being up to date on their mortgage payments. Only eight percent of homeowners report making a late payment in the last year, and just four percent report making multiple late payments within the past year. However, by late April, 44 percent of homeowners were somewhat or very concerned with making their mortgage payments in the next 90 days.

According to the Mortgage Bankers Association’s Apr. 18 Forbearance and Call Volume Survey, loans in forbearance increased from 7.91 percent of servicers’ portfolio volume to 8.16 percent–roughly 100 times greater than the early March baseline. As unemployment continues its upward climb (nearly 40 million Americans out of work), the number of borrowers in financial straits will likely continue to grow, “suggesting we are far from seeing a forbearance peak,” STRATMOR said.

The study said in addition to the more immediate (90-day) concerns about ability to pay, data suggest a potential second wave of economic impact will come within four to six months. Of the 1,000 surveyed, 27 percent do not foresee being able to make their mortgage payments for more than five months.

“Mortgage-adjacent industries like real estate, largely dependent on in-person home viewings and credit worthy consumers, may be facing a long road ahead even as quarantine restrictions are eased,” STRATMOR said.

When asked about their knowledge of government COVID-19 assistance programs, 61 percent of the respondents had either no knowledge of COVID-19 assistance programs or were unsure if the available assistance applies to them. Thirteen percent of respondents either think the government will be making their payments for them or that they’ll just be able to skip their payments during the pandemic.

“This should be a wake-up call to servicers to ramp up communication efforts to help borrowers understand their available payment options,” STRATMOR said.

The study said the mortgage industry, at least in the near-to-mid-term, fares “relatively well” in most COVID-19 scenarios, noting low interest rates are fueling another wave of refinances that could offset a decline in purchase originations resulting from unemployment, fear and a decline in borrower financial assets that would otherwise be a source of down payments.

“The mortgage industry also has been relatively immune to stay-at-home quarantine requirements,” the study said. “Most mortgage companies have been able to transition smoothly to having virtually all of their origination and servicing staff work from home. Adoption of electronic closings and remote online notarizations have sharply increased to allow loans to be fulfilled without face-to-face contact between a borrower and fulfillment workers.”

Despite the advantages, however, the study warned the industry is facing an extremely challenging environment once refinances wane. “Depression-like unemployment is not conducive to a robust housing market,” STRATMOR said. “Lenders need more than just a short-term plan to address the coming waves of borrowers in crisis.”

The study offered the following recommendations to mortgage companies:

–Invest in and implement digital mortgage operations and practices to alter the processes and costs of mortgage origination and servicing.

–Build brand loyalty and emotional equity with customers by reaching out proactively to discuss options and to take care of the customer.

–Automate wherever possible. Many in-place systems are already equipped with the tools needed to ramp up communications with borrowers such as auto-emails from the president, short videos such as those created by MBA or the Consumer Financial Protection Bureau.