Older, Younger Millennials Diverge on Loan Preferences

With interest rates continuing to hover at historic lows—the Mortgage Bankers Association yesterday pegged the 30-year fixed rate at a record-low 2.92 percent—Millennials appear to be diverging on loan preferences, said Ellie Mae, Pleasanton, Calif.

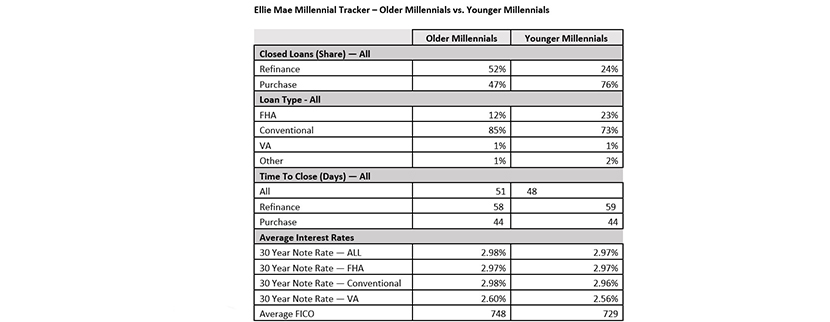

The company’s monthly Millennial Tracker reported younger Millennials in particular took advantage of historically low FHA loan interest rates. Sixteen percent of home loans closed by millennial borrowers in October were FHA loans, secured with an interest rate of 2.99%, the lowest rate since Ellie Mae began tracking this data in 2016.

“FHA loans were especially popular among younger millennials under age 30,” said Joe Tyrrell, president of ICE Mortgage Technology. “Nearly a quarter of them chose this financing option, in part because of the more flexible qualification criteria; however, older millennials preferred conventional loan products.”

Ellie Mae reported 93% of all closed FHA loans to millennials were for purchases in October, down one percentage point from September, while 7 percent were for refinances. Purchase loans closed by millennial borrowers – across all loan types – held steady month-over-month at 56 percent, as did refinances at 43 percent.

The report said days-to-close across all loans remained the same from September to October at 49 days. FHA loans also took 49 days to close, a day longer than September. Ellie Mae also reported slight upticks in days-to-close for conventional loans month-over-month from 49 to 50 days, and for VA loans from 55 to 60 days.

Ellie Mae tracks older millennials as between 30 and 40 years old and younger millennials as between 21 and 29 years old.