BREAKING NEWS

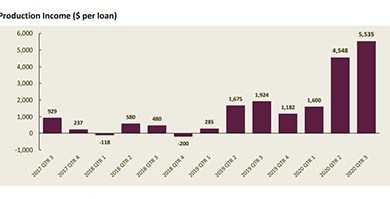

MBA: Independent Mortgage Banks Post Strong 3Q Profits

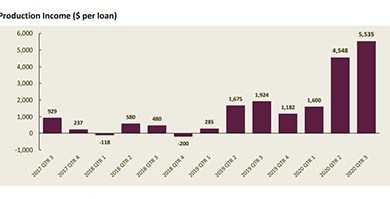

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net gain of $5,535 on each loan they originated in the third quarter, up from $4,548 per loan in the second quarter, the Mortgage Bankers Association reported this morning in its Quarterly Mortgage Bankers Performance Report.

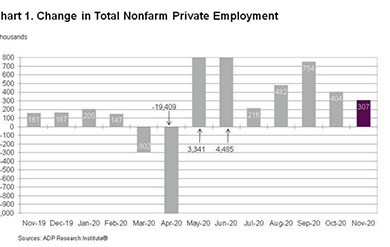

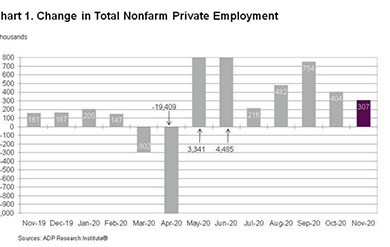

Ahead of this morning’s weekly Initial Claims report by the Labor Department and Friday’s Employment report by the Bureau of Labor Statistics, ADP, Roseland, N.J., said private-sector employment increased by 307,000 jobs from October to November.

The Federal Housing Finance Agency said Fannie Mae and Freddie Mac will extend the moratoriums on single-family foreclosures and real estate owned (REO) evictions until at least January 31, 2021.

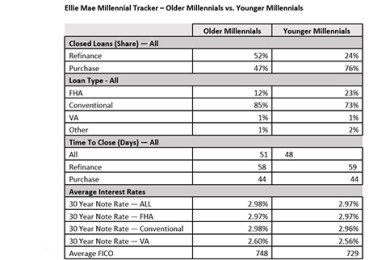

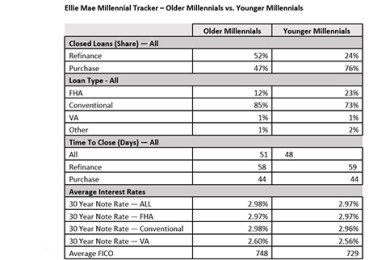

With interest rates continuing to hover at historic lows—the Mortgage Bankers Association yesterday pegged the 30-year fixed rate at a record-low 2.92 percent—Millennials appear to be diverging on loan preferences, said Ellie Mae, Pleasanton, Calif.

As expected, the Federal Housing Administration yesterday matched Fannie Mae and Freddie Mac in its single-family and Home Equity Conversion Mortgage insurance programs for 2021.

Looking to work with an AMC partner? Here are some areas to consider as you make your choice.

The Mortgage Bankers Association’s grassroots advocacy arm, the Mortgage Action Alliance, is holding elections for three at-large seats on its 2021-2022 MAA Steering Committee. The active voting period will be open until Wednesday, Dec. 9 at 5:00 p.m. ET.

MBA NewsLink interviewed Bruno Pasceri, President of Incenter LLC and a mortgage industry leader for more than 30 years, about the mortgage banking market and how to navigate future changes.

The non-QM market is making a recovery and, with continued demand from borrowers, changes to the current QM lending rule and the approaching expiration of the QM patch, is likely to stay on the rebound. As a new range of products come to the market, the question now becomes, how can the mortgage industry ramp up and ensure loan quality for lenders, servicers, and investors?

ReverseVision, San Diego, updated all documents that reference an index to support both the Constant Maturity Treasury (CMT) and London Interbank Offer Rate (LIBOR) indexes.

Walker & Dunlop, Bethesda, Md., structured $84.3 million in financing for The Residences at Annapolis Junction, a 416-unit Class A apartment community that delivered in 2018.

KBRA just released its 2021 Sector Outlook: CMBS: Slow and Steady report. As the real estate finance industry grapples with increased infection rates approaching the holiday season and how to think about 2021, MBA NewsLink sat down with KBRA’s Patrick McQuinn and Sacheen Shah to get their insights.

Despite sustained record-low interest rates, mortgage applications dipped slightly during the holiday-shortened Thanksgiving week, the Mortgage Bankers Association reported this morning in its Weekly Mortgage Applications Survey for the week ending November 27.