ICE Mortgage Technology, Pleasanton, Calif., said the number of purchase loans closed by millennials in May jumped to 67%; for younger millennials, the percentage was even higher (82%).

Tag: Millennial Tracker

ICE: Millennial Purchase Activity Increases Despite Rising Rates

ICE Mortgage Technology, Pleasanton, Calif., said purchase activity among millennials increased in March, even as interest rates rose for the first time in six months.

Millennials Get Comfortable with Mortgage Process

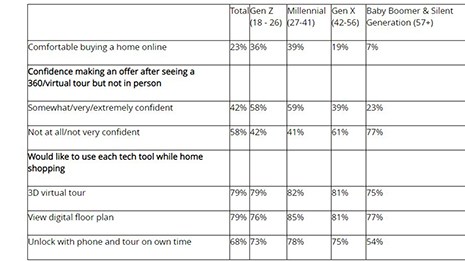

Reports from ICE Mortgage Technology and Zillow illustrate not only how comfortable they have become with the mortgage process—particularly online—but also in what kind of mortgages they obtain.

Millennials Rush to Refinance Amid Record Low Rates

Ellie Mae, Pleasanton, Calif., said refinance activity climbed to 45% of all loans closed by millennial borrowers in November, up three percentage points from October to the highest percentage since May.

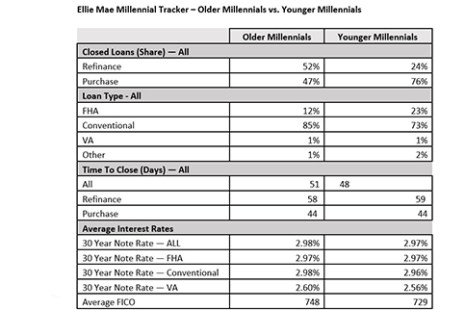

Older, Younger Millennials Diverge on Loan Preferences

With interest rates continuing to hover at historic lows—the Mortgage Bankers Association yesterday pegged the 30-year fixed rate at a record-low 2.92 percent—Millennials appear to be diverging on loan preferences, said Ellie Mae, Pleasanton, Calif.

Millennials Jump on Low Rates

With interest rates nearing 3% for all loans, many millennials took advantage of the opportunity to refinance their mortgages in September, according to Ellie Mae, Pleasanton, Calif.

Ellie Mae: Low Interest Rates Spur Millennials to Action

Millennials continue to take advantage of record-low interest rates, according to Ellie Mae, Pleasanton, Calif.

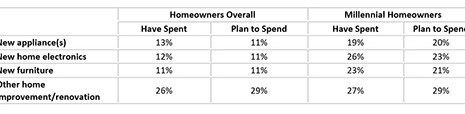

Millennial Update: They’re Buying Houses and Going into Debt to Fix Them Up

Reports by Ellie Mae and Bankrate.com show Millennials are pulling out their wallets not only to purchase homes, but to fix them up as well.

Millennial Homeownership ‘Delayed, Not Denied’

Despite the economic effects of the coronavirus pandemic, millennials appear poised to fuel a “Roaring ’20s” of homeownership demand, said First American Financial Corp., Santa Ana, Calif.

Ellie Mae: Low Rates Spur Refinance Activity to Historic High

Ellie Mae, Pleasanton, Calif., said refinance activity reached a record high in March for millennial borrowers as interest rates plummeted.