MBA Advocacy Update–Dec. 21, 2020

MBA – along with several trades – sent a letter to Treasury Secretary Steven Mnuchin expressing concerns regarding the possible release of the GSEs from conservatorship. On Wednesday, FHFA released a final rule extending the current single-family and multifamily GSE affordable housing goals by one year, through 2021.

MBA, Trade Groups Ask Federal Agencies for Clarity on CARES Act Forbearance

The Mortgage Bankers Association, the American Bankers Association and the Housing Policy Council on Thursday asked federal agencies to issue guidance establishing a consistent timeframe for CARES Act forbearance under their respective programs.

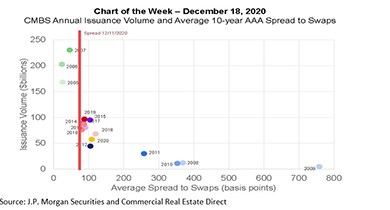

MBA Chart of the Week: CMBS Annual Issuance Volume

One way to gauge potential commercial mortgage-backed securities issuance volume is by looking at the spreads investors are willing to pay for bonds. Based on current new-issue spreads, 2021 could line-up to be a strong year.

Industrial, Apartment Prices Rise as Retail Prices Fall

Real Capital Analytics, New York, reported commercial property prices grew in November at the fastest annual pace since the pandemic began.

The Week Ahead—Dec. 21, 2020

With Christmas—and the Christmas holiday break—just days away, the situation in Washington is, as usual, as chaotic as it could be. As of this writing, House and Senate negotiators are STILL working on a substantial $900 billion-plus coronavirus relief bill, which is keeping the 116th Congress from formally adjourning. And there’s still the defense appropriations bill, which triggered yet another government shutdown on Friday.