Industrial, Apartment Prices Rise as Retail Prices Fall

Chart courtesy of Real Capital Analytics

Real Capital Analytics, New York, reported commercial property prices grew in November at the fastest annual pace since the pandemic began.

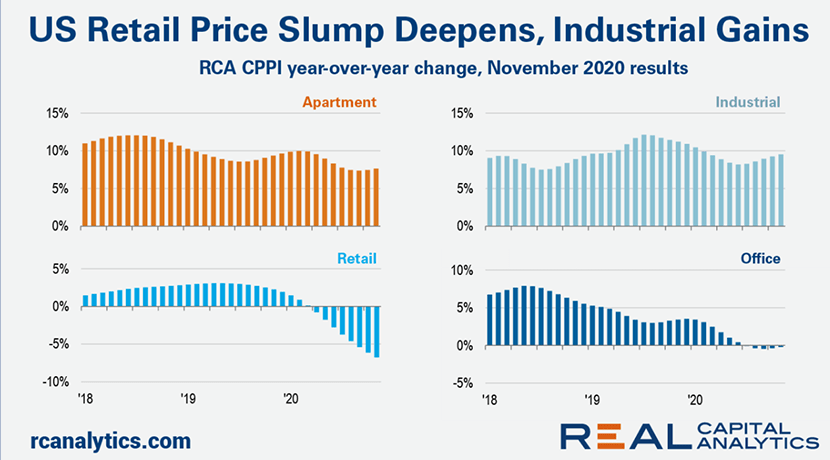

As seen in recent months, strong industrial and apartment property price gains boosted the overall number. RCA Senior Analyst Wyatt Avery said the firm’s All-Property Index increased 5.7 percent from a year ago, even while retail sector’s price slump deepened.

Industrial prices climbed 9.5 percent in November, Avery said. “Although deal volume has fallen in the logistics sector this year, there is still an appetite for these properties and that demand has driven price growth in the sector,” he said.

Industrial property sales volume is down 26 percent compared for the year through November compared to 2019 levels, Avery said.

Apartment property prices posted a 7.6 percent increase from November 2019, RCA said. Apartment sector annual returns have hovered in the mid-7 percent range over the last few months as the early-pandemic deceleration started to turn around.

“By contrast, retail prices have sunk further,” Avery said. The retail index dropped 6.7 percent year-over-year in November, reflecting the distress the sector faces. Distressed retail assets represent nearly two-fifths of all outstanding U.S. commercial real estate distress and one-quarter of potential distress, Avery said.

Green Street, Newport Beach, Calif. reported its price index of real estate investment trust-owned properties increased for most property types in November. Its Commercial Property Price Index increased by 1.8 percent in November.

“Property pricing has firmed up over the past few months,” said Green Street Managing Director Peter Rothemund. “In several sectors it’s above, or close to, pre-Covid levels.”

Only the harder-hit property types remain down 10 percent or more, Rothemund noted. “With interest rates this low–and a vaccine coming–that’s not surprising.”

Rothemund said commercial real estate cap rates in the 5 percent range look very attractive to investors when BBB-rated corporate bonds yield closer to 2 percent, “or perhaps 3 percent if one really stretches on term,” he said.