The Federal Housing Finance Agency on Thursday published a final rule amending the Enterprise Regulatory Capital Framework by introducing new public disclosure requirements for Fannie Mae and Freddie Mac.

Category: News and Trends

MBA Home For All Pledge Partner: CoreLogic

(One in a series of profiles of MBA member companies that have signed the MBA Home For All Pledge, an initiative to promote inclusion in housing.)

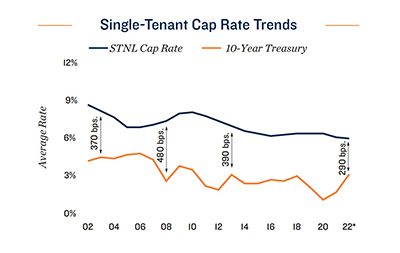

Single-Tenant Retail Sector Benefits from Changing Consumer Behavior

Marcus & Millichap, Calabasas, Calif., said the single-tenant net leased retail sector is benefiting from evolving consumer behavior.

Pending Home Sales Fall 6th Straight Month

Pending home sales fell by nearly 4 percent in April—the sixth consecutive monthly drop—the National Association of Realtors reported Thursday.

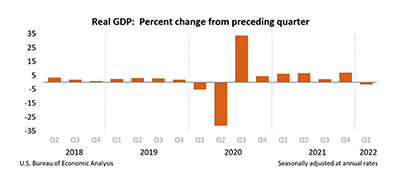

Mixed Bag as 1Q GDP Revises to -1.5%

Real gross domestic product decreased at an annual rate of 1.5 percent in the first quarter, according to the “second” (revised) estimate Thursday by the Bureau of Economic Analysis.

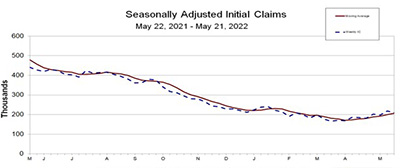

Initial Claims Drop by 8,000

Initial claims for unemployment insurance fell for the first time in three weeks, the Labor Department reported Thursday.

MISMO Seeks Public Comment On Business Glossary User Guide

MISMO®, the real estate finance industry standards organization, seeks public comment on its MISMO Business Glossary User Guide.

Dealmaker: CBRE Arranges $105M for Florida Resorts

CBRE, Dallas, arranged a $105 million loan that refinanced the relaunched Bellwether and Beachcomber Resorts in St. Pete Beach, Fla.

MBA Offices Closed Monday

Offices of the Mortgage Bankers Association will be closed this Monday, May 30 in observance of the Memorial Day holiday.

Quote

“Despite strong employment and wage growth, housing affordability has worsened since the start of the year. Mortgage payments are taking up a larger share of homebuyers’ incomes and sky-high inflation is making it more difficult for some would-be buyers to save for a down payment or come up with the additional cash they need to afford a higher monthly payment.”

–Edward Seiler, MBA Associate Vice President of Housing Economics and Executive Director of the Research Institute for Housing America.