Single-Tenant Retail Sector Benefits from Changing Consumer Behavior

Marcus & Millichap, Calabasas, Calif., said the single-tenant net leased retail sector is benefiting from evolving consumer behavior.

“Despite inflation and rising fuel prices, during the early months of 2022 retail spending gains have been widely distributed across store-based segments, which excludes purchases made online,” M&M said in its second-quarter Single-Tenant Net Leased Retail National Report. “This suggests a broader shift in consumer behavior is ongoing, one with an emphasis on physical locations.”

Store-based retail sales accounted for nearly two-thirds of all core retail spending in March and April, the report noted. Inflation-adjusted core retail sales are up nearly 18 percent compared to before the pandemic. “Store-based sales momentum has the potential to remain positive moving forward, as U.S. households have more cash savings than debt and the economy is expected to recoup all jobs lost during the pandemic by this summer,” the report said.

Record-high gas prices are also changing consumer behavior, M&M said. “The ongoing stretch of elevated fuel costs that began in February is changing how households shop,” the report said. “Some are making fewer trips to grocers and other necessity-based stores while increasing the number of items purchased per visit. Others are frequenting restaurants and fast-food chains closer to where they live rather than travel to downtowns. This shift has aided suburban retail, with overall vacancy outside core locations falling below the central business district during the first quarter for the first time on record.”

Retailers are changing their store footprints as the sector evolves, the report said. “Responding to shifts in consumers’ expectations and shopping habits that were accelerated by the pandemic, a mix of single-tenant retailers are reinventing themselves to support market expansion and capture new audiences,” M&M said. “Small-store formats have emerged as a primary avenue to achieving these goals, a trend that has the potential to bolster competition for available space. Department stores, including Macy’s and Bloomingdale’s and supercenters like Meijer and BJ’s Wholesale Club, have recently launched smaller-scale operations [in population-dense urban settings and suburban neighborhoods].”

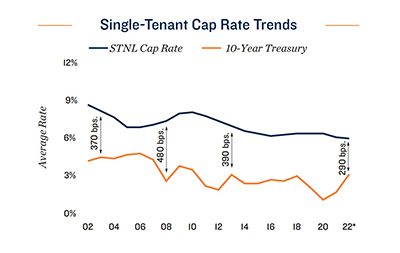

Several factors are increasing single-tenant retail property sales, the report said. “Encouraging metrics in job creation, household savings and unemployment are bolstering the appeal of net-leased retail investment despite high inflation and downward pressure on cap rates across market types,” it said. “Moving forward, owners of apartments may capitalize on high pricing in the multifamily segment and take the opportunity to sell into consistency, moving equity via 1031 exchanges into less management-intensive single-tenant properties, including drug stores, that provide long-term cash flow.”

Recent deal flow suggests this movement has already started, as single-tenant retail property sales activity rose by 45 percent over the past year that ended in March. Many investors seek assets occupied by high-credit grade tenants that proved resilient during the health crisis. “For these buyers, major metros noting strong in-migration are targets, with competition for properties in outer suburbs poised to accelerate,” M&M said.