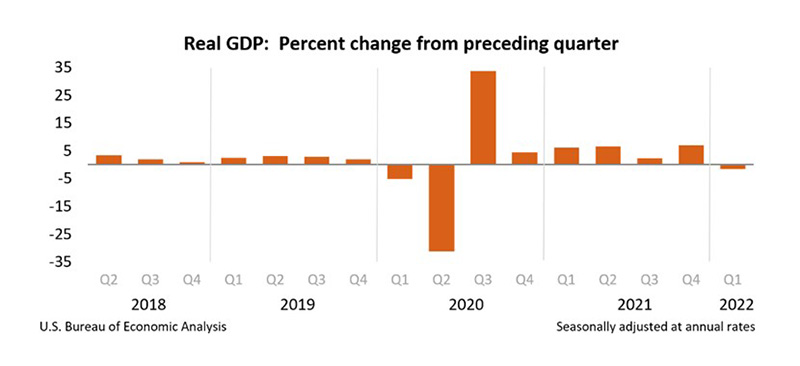

Mixed Bag as 1Q GDP Revises to -1.5%

Real gross domestic product decreased at an annual rate of 1.5 percent in the first quarter, according to the “second” (revised) estimate Thursday by the Bureau of Economic Analysis.

The GDP estimate released today is based on more complete source data than were available for the “advance” estimate issued last month. In the advance estimate, the decrease in real GDP was 1.4 percent. The update primarily reflects downward revisions to private inventory investment and residential investment that were partly offset by an upward revision to consumer spending.

In the fourth quarter, real GDP increased by 6.9 percent.

BEA said the decrease in real GDP reflected decreases in private inventory investment, exports, federal government spending and state and local government spending, while imports, which are a subtraction in the calculation of GDP, increased. Personal consumption expenditures, nonresidential fixed investment and residential fixed investment increased.

“Two volatile spending components—inventories and net exports—were largely responsible for the contraction in real GDP,” said Jay Bryson, Chief Economist with Wells Fargo Economics, Charlotte, N.C. “Specifically, the downshift in stock building in Q1 subtracted 1.1 percentage points off the overall rate of GDP growth while net exports made a negative contribution to growth that was worth 3.2 percentage points. As we wrote in a report on April 27 that warned of a negative print in the first estimate of GDP growth that was slated for release the following day, the contraction in output in the first quarter does not imply that the economy has slipped into recession.”

Bryson said with weaker demand unlikely to blame, higher costs weighed on profitability “In short, it will become more difficult for firms to pass costs on as demand softens,” he said.