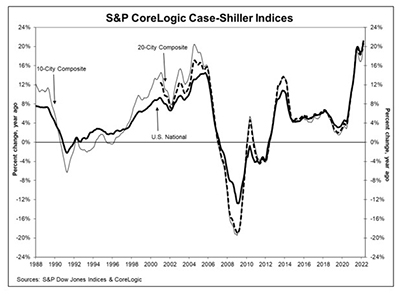

Home prices roared into March like a lion and left March like…well, a lion.

Category: News and Trends

Dealmaker: Cushman & Wakefield, Greystone Close Alabama Multifamily Sale, Financing

Cushman & Wakefield and Greystone arranged provided acquisition financing for City Heights Hoover, a 160-unit multifamily community in suburban Birmingham, Ala.

Patrick Gluesing: After Rapids of Refinance, Quality Mortgages Calm the Waters

For the past two years, as rates plummeted to historical lows—due largely to outside factors—originators and servicers have enjoyed the rushing rapids of origination volume. Now that rates are rising and refi volumes have slowed, organizations need to find other areas of growth, such as non-QM loans and mortgage servicing rights.

Quote

“Purchase applications were 14 percent lower than last year, with more activity in the larger loan sizes. Demand is high at the upper end of the market, and supply and affordability challenges are not as detrimental to these borrowers as they are to first-time buyers.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

MBA Advocacy Update May 31 2022

On Wednesday, the Senate voted 49-46 to confirm Sandra Thompson as the Director of FHFA. On Tuesday, MBA sent a letter to the chairs and ranking members of the House and Senate Appropriations Committees, highlighting MBA’s views on the real estate finance industry’s priorities within the T-HUD appropriations bills for FY 2023.

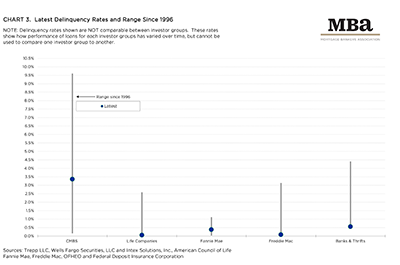

MBA: 1Q Commercial, Multifamily Mortgage Delinquency Rates Drop

Commercial and multifamily mortgage delinquencies declined in the first quarter, the Mortgage Bankers Association reported Tuesday in its Commercial/Multifamily Delinquency Report.

MBA CONVERGENCE Partner Profile: Dan Ticona of Freddie Mac

Dan Ticona leads the Housing Solutions team within the Single-Family Client and Community Engagement division at Freddie Mac, McLean, Va., focused on developing innovative solutions to reduce barriers to homeownership.

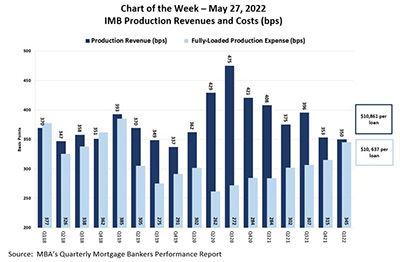

MBA Chart of the Week May 27, 2022: IMB Production Revenues and Costs

MBA last week released its latest Quarterly Performance Report for the first quarter. In this week’s Chart of the Week, we show production revenues compared to production expenses from first quarter 2018 to first quarter 2022.

MBA Home For All Pledge Partner: CoreLogic

(One in a series of profiles of MBA member companies that have signed the MBA Home For All Pledge, an initiative to promote inclusion in housing.)

Tom Lamalfa: May 2022 Secondary Market Conference Survey Report and Scorecard

Tom Lamalfa is a 44-year veteran of mortgage market research, whose focus in recent years has been on federal housing policy. He is president of TSL Consulting, Cleveland Heights, Ohio. His semi-annual reports on the housing and mortgage finance industries appear regularly in MBA NewsLink.