MBA: 1Q Commercial, Multifamily Mortgage Delinquency Rates Drop

Commercial and multifamily mortgage delinquencies declined in the first quarter, the Mortgage Bankers Association reported in its Commercial/Multifamily Delinquency Report.

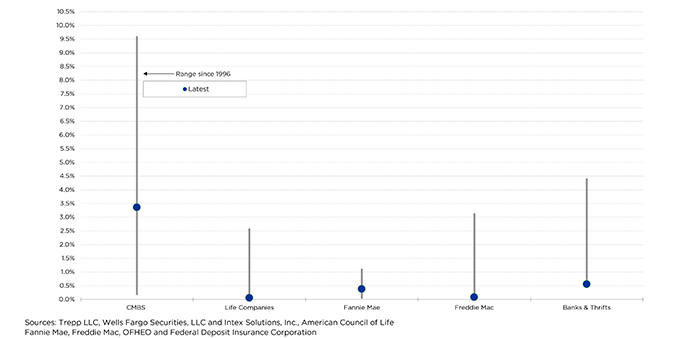

“Commercial and multifamily mortgage delinquency rates that were elevated by the onset of the COVID-19 pandemic continued to come down during the first quarter,” said Jamie Woodwell, MBA Vice President of Commercial Real Estate Research. “Given the strength in market fundamentals and valuations for most property types, delinquency rates are at the lower end of their historical range for most major capital sources.”

Based on the unpaid principal balance of loans, delinquency rates for each group at the first quarter’s close were as follows:

- Banks and thrifts (90 or more days delinquent or in non-accrual): 0.56 percent, a decrease of 0.03 percentage points from the fourth quarter;

- Life company portfolios (60 or more days delinquent): 0.05 percent, an increase of 0.01 percentage points from the fourth quarter;

- Fannie Mae (60 or more days delinquent): 0.38 percent, a decrease of 0.04 percentage points from the fourth quarter;

- Freddie Mac (60 or more days delinquent): 0.08 percent, unchanged from the fourth quarter; and

- Commercial mortgage-backed securities: (30 or more days delinquent or in REO): 3.36 percent, a decrease of 0.66 percentage points from the fourth quarter.

Construction and development loans are generally not included in the numbers presented in this report but are included in many regulatory definitions of ‘commercial real estate’ despite the fact they are often backed by single-family residential development projects rather than by office buildings, apartment buildings, shopping centers or other income-producing properties. The FDIC delinquency rates for bank- and thrift-held mortgages reported here do include loans backed by owner-occupied commercial properties. Differences between the delinquencies measures are detailed in Appendix A.

The MBA quarterly analysis looks at commercial/multifamily delinquency rates for five of the largest investor-groups: commercial banks and thrifts, commercial mortgage-backed securities, life insurance companies and Fannie Mae and Freddie Mac. Together, these groups hold more than 80 percent of commercial/multifamily mortgage debt outstanding. MBA incorporates the measures used by each individual investor group to track the performance of their loans. Because each investor group tracks delinquencies in its own way, delinquency rates are not comparable from one group to another. For example, Fannie Mae reports loans receiving payment forbearance as delinquent, while Freddie Mac excludes those loans if the borrower is in compliance with the forbearance agreement.

To better understand the ways the COVID pandemic is and is not affecting commercial mortgage performance, MBA worked with its servicer members to develop the CREF Loan Performance Survey. Click here for more information on the most recent results and the historical series.