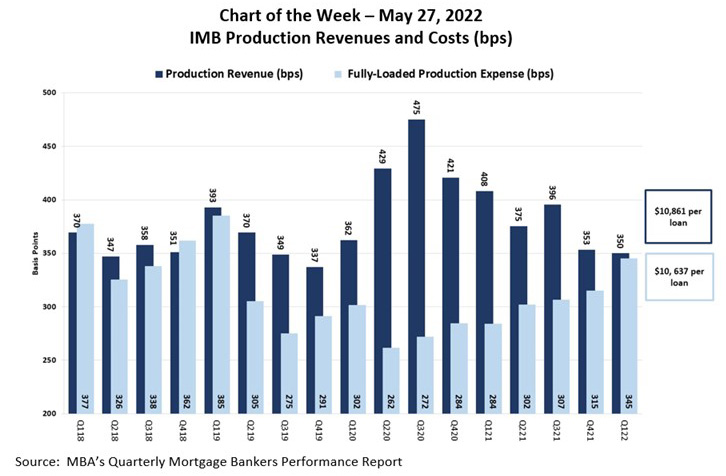

MBA Chart of the Week May 27, 2022: IMB Production Revenues and Costs

MBA last week released its latest Quarterly Performance Report for the first quarter. The total sample of 366 independent mortgage banks and mortgage subsidiaries of chartered banks earned an average pre-tax production profit of 5 basis points (or $223) on each loan they originated – the lowest level since fourth quarter 2018 and well below the quarterly average of 55 basis points dating back to 2008.

In this week’s Chart of the Week, we show production revenues compared to production expenses from first quarter 2018 to first quarter 2022. Total production revenue (fee income, net secondary marking income and warehouse spread) decreased to 350 bps in first quarter 2022, down from 353 bps in fourth quarter 2021 and 408 basis points from one year ago.

While lower production revenue contributed to scant profit margins, the primary driver was cost. Total loan production expenses – commissions, compensation, occupancy, equipment and other production expenses and corporate allocations – increased to 345 basis points in the first quarter, from 315 basis points in the fourth quarter. On a per-loan basis, production expenses ballooned to a new study-high $10,637 per loan in the first quarter, up more than $1,000 per loan from the fourth quarter and more than $2,500 per loan from one year ago.

–Jenny Masoud jmasoud@mba.org; Marina Walsh, CMB mwalsh@mba.org.