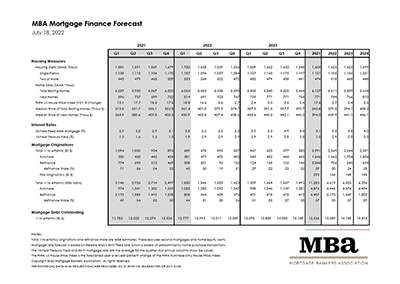

The Mortgage Bankers Association released updated Economic and Mortgage Market forecasts Thursday.

Category: News and Trends

Call for Entries: MBA DEI Leadership Awards–Deadline Aug. 5

The Mortgage Bankers Association is accepting entries for its annual Diversity, Equity and Inclusion Residential Leadership Awards; entry deadline is Friday, Aug. 5. Annually, MBA recognizes residential and commercial/multifamily members …

8 Common Fair Lending Compliance Myths Debunked

Michael Berman is Founder & CEO of Ncontracts, Brentwood, Tenn. Ncontracts provides integrated risk management and lending compliance software to a rapidly expanding customer base of over 4,000 financial institutions, fintechs and mortgage companies in the United States.

Industry Briefs From LenderLogix, ICE Mortgage Technology, Biz2Credit, FundingShield

LenderLogix, Buffalo, N.Y., announced its QuickQual integration is now built leveraging Encompass Developer Connect and available through ICE Mortgage Technology, part of Intercontinental Exchange, Inc.

MBA Weighs In to Support Improving Access to the VA Home Loan Benefit Act

The Mortgage Bankers Association supports modernizing and streamlining the homebuying process for our nation’s veterans, including efforts related to home appraisals, MBA told Members of Congress.

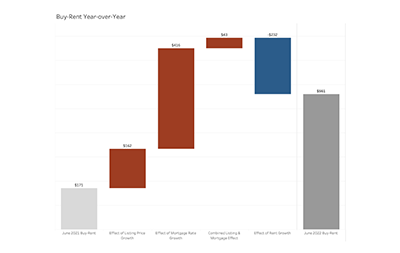

Renting More Affordable than Buying Starter Home in Most Large Cities

Higher mortgage rates are increasingly tipping the housing affordability scale in favor of renting over first-time buying, the National Association of Realtors reported.

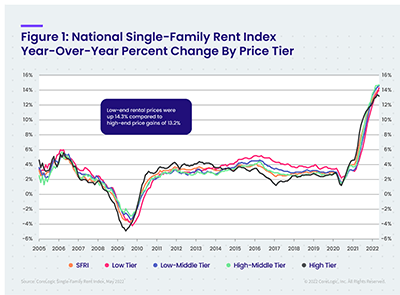

CoreLogic: Annual Single-Family Rent Growth Holds Steady at Record High in May

CoreLogic, Irvine, Calif., said annual U.S. single-family rent growth remained at a record high in May, posting a 13.9% increase from May 2021.

Sales Boomerang: Surge in Credit Improvement Alerts Suggests Opportunity for Lenders to Revisit Turndowns

Sharp increases in cash-out, credit-improvement and new-listing alerts quarter-over-quarter point to opportunity for lenders in a contracting mortgage market, reported Sales Boomerang, Owings Mills, Md.

Dealmaker: MCR Closes on $420M Hotel Portfolio Refinancing

MCR, New York, closed on a $420 million refinancing of 30 hotels across the country.

DBRS Morningstar: Solid Credit Performance for Non-QM RMBS

The credit performance of residential mortgage-backed securities backed by non-Qualified Mortgage loans rated by DBRS Morningstar remained steady in the first half of 2022, the ratings firm reported.