When the mortgage industry is in a constant state of change, it’s important for lenders to stay on top of their game. With new reports coming out every day about market dynamics, competitive pressures, supply shortages and the persisting economic impacts of the global pandemic – mortgage lenders may be seeking ways to remain profitable and compliant.

Category: News and Trends

MISMO Launches Commercial Green Borrower Questionnaire

MISMO®, the real estate finance industry standards organization, announced availability of its Commercial Green Borrower Questionnaire.

MISMO Fall Summit in D.C. Aug. 29-Sept. 1

The MISMO Fall Summit takes place Aug. 29-Sept. 1 at the Fairmont Georgetown Hotel in Washington, D.C.

MBA Advocacy Update Aug. 8 2022: Senate Passes Reconciliation Package

The Senate on Sunday passed a $740 billion reconciliation package. And last Monday, the VA released Circular 26-22-13, implementing new appraisal procedures for VA purchase loans.

Marvin Chang of Mortgage Hippo: Three Reasons Lenders Must Lean Into Innovation

Lenders that hunkered down during the last two major industry downturns are no longer in the business, while those that leaned in and innovated during the same period emerged as industry leaders. Now is not the time for timidity. In fact, leading lenders are leaning into innovation now. There are at least three good reasons to do so.

Jim Paolino of Lodestar: By the Numbers–Did Increased WFH Opportunities Help Spur Home Buying in Metro Suburbs?

Two years after the height of the COVID lockdown, there’s lots of new data available to prove (or disprove) some of the early predictions and observations regarding home buying patterns and trends.

Mark P. Dangelo: In Perspective, the Fragmentation of the Mortgage Industry

Reimaging of the mortgage markets has begun—driven by shrinking margins, rising rates, and inflationary pressures. Yet, for all the actions since 2010 involving data standards, digital transformations, and customer experiences, what is missing? Who will be left standing as the next cycle takes form and the mortgage industry is digitally reimaged?

Quote

“Credit availability fell last month to the lowest level since May 2013, as lenders streamlined their loan offerings in this declining volume environment. The 9 percent decline in the July index was the largest monthly decrease since April 2020. Lenders have responded accordingly to the decrease in demand for refinance and purchase loans by reducing loan offerings, including for ARMs, cash-out refinances and investment properties.”

–Joel Kan, MBA Associate Vice President of Economic and Industry Forecasting.

Dale Larson III of Modex: The Data-Driven Evolution of Loan Officer Hiring

According to a 2019 McKinsey study, lack of production data is the number one cause of poor hiring decisions across the mortgage industry.

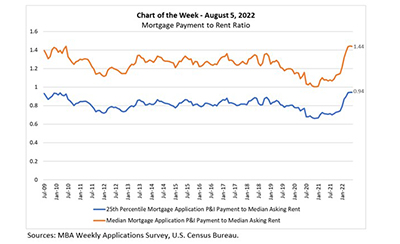

MBA Chart of the Week Aug. 8, 2022: Mortgage Payment to Rent Ratio

This MBA Chart of the Week examines the relationship between mortgage payments and asking rents since the second half of 2009. MBA’s national mortgage payment to rent ratio compares the national median and 25th percentile mortgage payments to the national median asking rent.