There’s more to adopting a digital mortgage strategy than simply using the necessary technologies and processes. Successful adoption also depends on getting clear and explicit buy-in from key stakeholders, such as borrowers, lender team members and settlement agents. By getting these crucial groups on board, lenders can then make the digital mortgage experience intuitive, consistent and repeatable.

Category: News and Trends

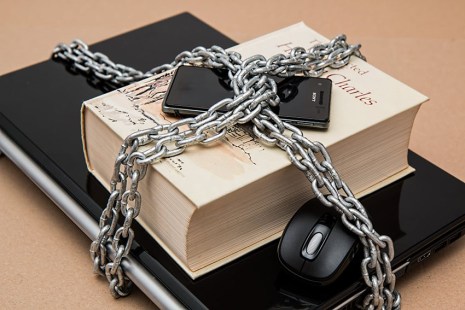

The New State Battleground: Privacy & Security

On January 1, the California Consumer Privacy Act (CCPA) became law–a warning shot across the bow of every real estate finance company in America.

People in the News

The Federal Housing Finance Agency announced J. Christopher “Chris” Giancarlo, former Chairman of the U.S. Commodity Futures Trading Commission, will serve as independent, non-Executive Chairman of the Board of Directors of Common Securitization Solutions LLC and that CSS will amend the structure of its Board of Directors.

Nancy Alley: eClosing Best Practices, Part II: Driving Adoption with Key Stakeholders

There’s more to adopting a digital mortgage strategy than simply using the necessary technologies and processes. Successful adoption also depends on getting clear and explicit buy-in from key stakeholders, such as borrowers, lender team members and settlement agents. By getting these crucial groups on board, lenders can then make the digital mortgage experience intuitive, consistent and repeatable.

To the Point with Bob: Reducing False Claims Act Risk in FHA Lending

In the latest entry of his blog series, To the Point with Bob, Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, discusses HUD’s efforts to improve the FHA loan review process, as well as MBA’s advocacy to support those efforts.

December New Home Purchase Mortgage Applications Dip But Finish Year Strong

The Mortgage Bankers Association this morning said mortgage applications for new home purchases in December fell by 5 percent from November but improved by nearly 39 percent from a year ago.

Stanley C. Middleman: Are Non-banks Really a Systemic Risk?

The Financial Stability Oversight Council issued its annual report in December where it identified the growth of nonbank mortgage origination and servicing as a risk to the U.S. financial system. But is this really correct?

Call for Nominations: MBA NewsLink 2020 Tech All-Star Awards; Deadline TODAY

The Mortgage Bankers Association and MBA NewsLink are accepting nominations for the MBA NewsLink 2020 Tech All-Star Awards. The nomination deadline is TODAY, Friday, Jan. 17.

Mark P. Dangelo: 2020—Where Are OUR Attack Points?

In this third and final article on 2020 potential challenges, we find ourselves staring into the glassy lake. The answers on what is important reside not with prescriptive solutions offered, but beneath the surface to ensure that what is undertaken aligns with strategy and the ability of innovations to be found.

To the Point with Bob: Reducing False Claims Act Risk in FHA Lending

In the latest entry of his blog series, To the Point with Bob, Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, discusses HUD’s efforts to improve the FHA loan review process, as well as MBA’s advocacy to support those efforts.