MBA Doubles 2020 Refinance Forecast

The Mortgage Bankers Association this week issued its revised Mortgage Finance Forecast and Economic Forecast, in which MBA doubled its previous 2020 refinance mortgage originations projections.

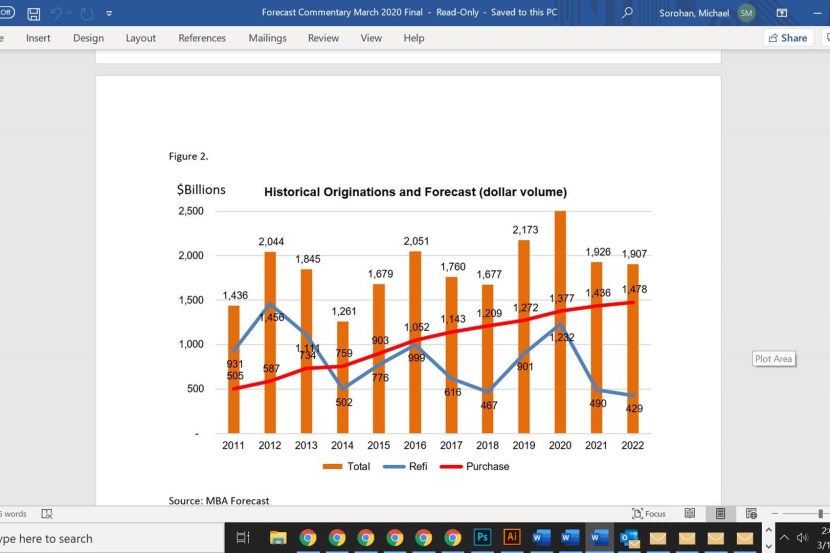

In response to the current interest rate environment, MBA now forecasts total mortgage originations to come in around $2.609 trillion this year–a 20.1 percent gain from 2019’s volume ($2.17 trillion). Refinance originations are expected to double earlier MBA projections, jumping 36.7 percent to $1.232 trillion. Purchase originations are now forecasted to rise 8.3 percent to $1.377 trillion.

The revised housing and economic forecast can be found at https://www.mba.org/news-research-and-resources/research-and-economics/forecasts-and-commentary.

In economic commentary, MBA Chief Economist Mike Fratantoni and MBA Associate Vice President of Economic and Industry Forecasting Joel Kan said global economic conditions are having a profound effect on the U.S. economy and the U.S. mortgage market

“The global economy had already been slowing even prior to the recent turmoil surrounding the coronavirus and the price war in the oil market,” they said. “Global stock markets and interest rates have plummeted. There are roughly even odds that the US could enter a recession this year, and we expect further rate cuts from the Fed at one or both of their next meetings.

The spread of the coronavirus to the U.S. and the uncertainty surrounding its potential economic impact have led to a further slide in rates and the increased risk of a severe slowdown in growth in the U.S. and globally, they noted. “As global governments act to quell the spread of the virus through travel restrictions and quarantines as people stay indoors to stay away from crowds, the adverse effect on economic growth will show up in consumer spending, exports and imports, and supply chain disruptions. In response to the uncertainty, the Fed cut the fed funds rate by half a percentage point two weeks before its scheduled March meeting, the first time since the financial crisis the Fed has done an intermeeting rate cut. Lower rates have led us to estimate significantly higher mortgage refinance volume, and we now anticipate an increase in refinancing in 2020, compared to the previously forecasted decline.”

Fratantoni and Kan noted the Fed rate cut was intended to provide some stimulus to cushion the economy from the impact of the expected slowdown in economic activity as the impact from the further spread of coronavirus reaches more countries. However, given the slowdown in global economic activity and its impact on exports and consumption for other trading partners, MBA downgraded its economic forecast to show considerably weaker growth in 2020, reducing growth from an already weak rate of 1.1 percent in last month’s forecast to 0.6 percent for all of 2020.

“Lower consumer spending and exports were some of the main drivers, and this will likely also cause payroll growth to slow and the unemployment rate to increase to at least four percent in 2020,” they said. “If there is no material change in the spread of the coronavirus or the rate at which it is spreading, we anticipate that growth will see a robust rebound back in 2021 and 2022 to growth rates of 2 percent or higher. Factories will be able to come back online to make up for some of the backlog of production and affected supply chains will slowly return to normal, although there will certainly be hiccups along the way, as different countries will likely recover at different rates.”

As highlighted in the most recent MBA Chart of the Week, the expectation of weaker growth pushed the yield on U.S. 10-year Treasuries to record lows this week, and the 30-year fixed mortgage rate, as published by Freddie Mac from its Primary Mortgage Market Survey, fell to a record low 3.29 percent. “The increase in mortgage-Treasury spreads shows the typical impact of a rapid increase in refinance volume as industry capacity constraints become binding,” they said. “We also expect that turn times, particularly for refinance loans, are likely to extend in the months ahead.”

They also noted in late summer 2019, refinance activity had started to gain momentum as rates decreased for different reasons, but refinance demand spiked even more last week, with MBA’s Weekly Application Survey showing conventional refinance applications increasing more than 30 percent from the week before.

“This month, our forecast is for mortgage rates to average around 3.4 percent for 2020, and we have revised our refinance forecast to a total of $1.2T for 2020 roughly double our previous forecast of $665B,” they said. “The revised refinance estimate is a 37 percent increase in refinance volume in 2020 relative to 2019. Additionally, we expect purchase originations to be stronger in 2020, showing an 8 percent increase for the year given the strength in new residential construction and in purchase applications to date. ”

While attention is focused on the days and weeks ahead, the conditions leading up to late February’s developments were still “solid,” the forecast said, noting February’s strong job growth. “The caveat is of course the uncertainty regarding the coronavirus, because even with these lower rates, the looming uncertainty may cause potential home buyers to delay such a large purchase and long term financial commitment if there is a threat to job security or future income.”