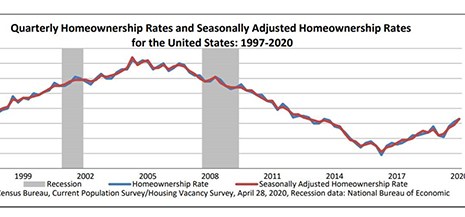

Pre-coronavirus, the nation’s homeownership continued its recovery in the first quarter, rising by 1.1 percent from a year ago to 65.3 percent, the Census Bureau reported yesterday.

Category: News and Trends

Dealmaker: Transwestern Brokers Six Office Properties for More than $80M

Transwestern Real Estate Services brokered disposition of six office properties in Huntsville, Ala., totaling 1.03 million square feet for more than $80 million.

February Home Prices Increase by 4.2% Annually

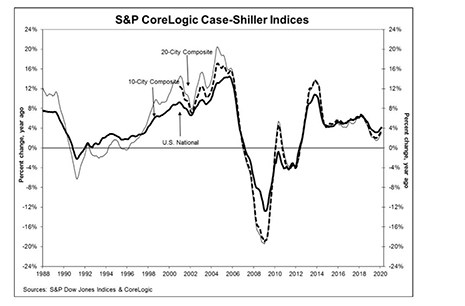

S&P Dow Jones Indices, New York, said its CoreLogic Case-Shiller U.S. National Home Price NSA Index reported a 4.2% annual gain in February, up from 3.9% in January.

To the Point with Bob: Repayment Options Are Crucial to Forbearance Strategy

In his latest blog, Mortgage Bankers Association President and CEO Robert Broeksmit, CMB, discusses the importance of repayment options as lenders and consumers work together on forbearance strategies.

April Consumer Confidence Takes Another Dive

The Conference Board, New York, said its Consumer Confidence Index deteriorated further in April, following a sharp decline in March. The Index now stands at 86.9, its lowest level since 2014, down from 118.8 in March and 130.7 in February.

Andrew Foster: Case-By-Case–Commercial Mortgage Forbearance Consideration Begins

While the hope remains that the recession will be short-lived with a strong recovery in the second half of 2020, commercial real estate typically lags the broader economy.

MBA Launches Advocacy Ad Campaign

The Mortgage Bankers Association yesterday launched a print and advertising campaign targeting Capitol Hill lawmakers, Washington “influencers” and consumers.

Paul Anselmo: The Moment Has Arrived for Remote Closings

As the real estate industry eyes its way forward through a new era of social isolation, one of the most pressing challenges has become how to close loans safely. To be sure, the traditional loan closing has gone from a celebratory event that takes place in person between title agents, notaries and borrowers to a legitimate health hazard.

Britt Faircloth: Fairness in the Face of Crisis–Fair and Responsible Banking in the Midst of Chaos

As a compliance officer, I have always recognized that change is constant, and I accept that fact sometimes grudgingly. While regulatory change generally has ample implementation or lead time, March 2020 has brought a different kind of change; one that is significant, sudden and jarring. These days you can’t just ask who moved your cheese—assuming you could find cheese in the grocery store, that is—you must quickly and effectively adapt to an entirely new normal.

Mark Dangelo: Are Bankers Necessary? Part 3

On April 14, JPMorgan CEO @JamieDimon indicated his operations were preparing for a “severe recession.” To state that the economic conditions we are living in are precarious and uncertain is almost meaningless. For most living today, we are in unchartered territory.